Now’s a Great Time To Sell Your House

Thinking about selling your house? If you are, you might be weighing factors like today’s mortgage rates and your own changing needs to figure out your next move.

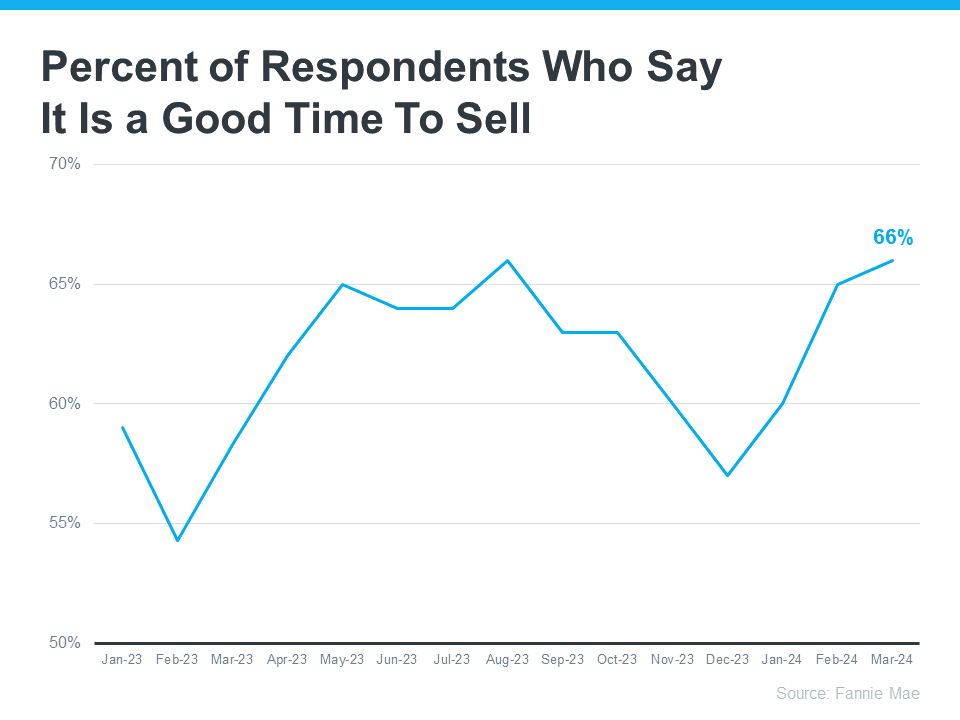

Here’s something else to consider. According to the latest Home Purchase Sentiment Index (HPSI) from Fannie Mae, the percent of respondents who say it’s a good time to sell is on the rise (see graph below):

Why Are Sellers Feeling so Optimistic?

One reason why is because right now is traditionally the best time of year to sell a house. A recent article from Bankrate says:

“Late spring and early summer are generally considered the best times to sell a house. . . . While today’s rates are relatively high, low inventory is still keeping sellers in the driver’s seat in most markets.”

These are the seasons when most people move. That means buyer demand grows. And because there still aren’t enough homes for sale to meet that demand, sellers see some serious perks. According to Rocket Mortgage:

“Homes that are listed at the end of spring and the beginning of summer typically sell faster at a higher sales price.”

What Does This Mean for You?

More sellers are coming to realize conditions are ripe for a move. And that’s one reason why we’re seeing more homeowners put their homes up for sale. If you think you might want to get in on the action, it’s a good idea to start preparing.

A local real estate agent can help you get your house ready by offering advice on how best to fix it up and make it appealing to buyers in your area.

They also know if you list during the peak buying seasons of spring and early summer, you might sell quickly and for a higher price.

Bottom Line

If you list during the spring and early summer, you might sell your house quickly and for a higher price. When you’re ready to make the most of today’s seller’s market, get in touch with a local real estate agent.