Don’t Wait for a Lower Mortgage Rate – It Could Cost You

Today’s housing market is truly one for the record books. Over the past year, we’ve seen the lowest mortgage rates in history. And while those rates seemed to bottom out in January of this year, the golden window of opportunity for buyers isn’t over just yet. If you’re one of the buyers who worry they’ve missed out, rest assured today’s mortgage rates are still worth taking advantage of.

Even today, our mortgage rates are below what they’ve been in recent decades. So, while you may not be able to lock in the rate your friend got recently, you’re still in a great position to secure a rate well below what your parents and even grandparents got in years past. The key will be acting sooner rather than later.

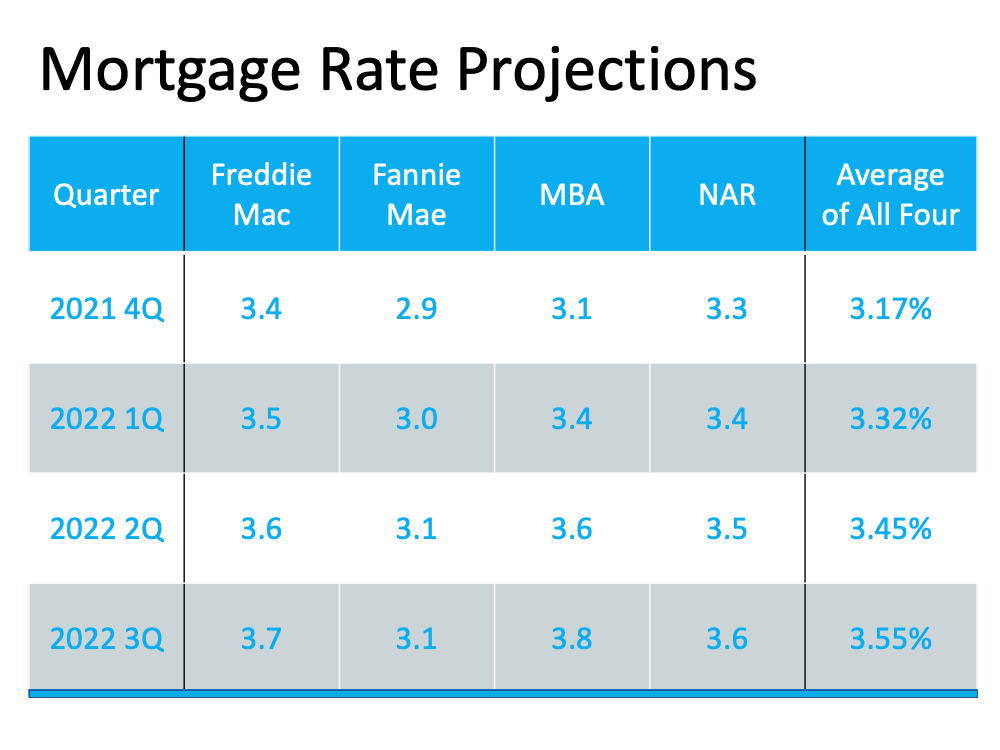

In late September, mortgage rates ticked above 3% for the first time in months. And according to experts throughout the industry, mortgage rates are projected to continue rising in the months ahead. Here’s where experts say rates are headed: While a projected half percentage point increase may not seem substantial, it does have an impact when you’re buying a home. When rates rise even slightly, it affects how much you’ll pay month-to-month on your home loan. The chart below shows how it works:

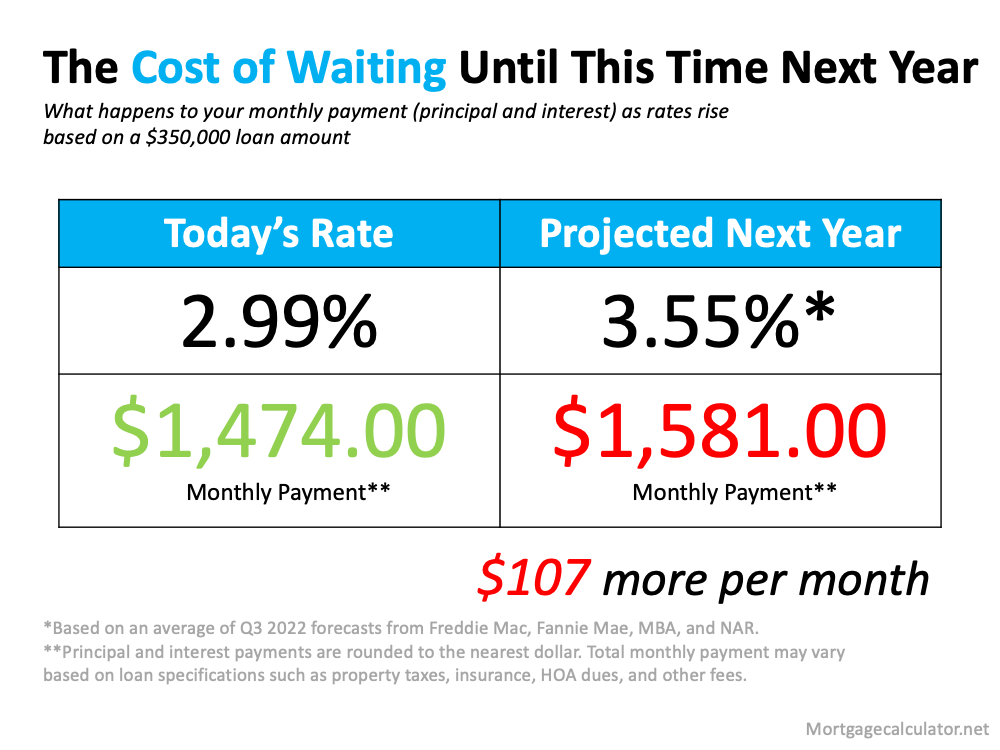

While a projected half percentage point increase may not seem substantial, it does have an impact when you’re buying a home. When rates rise even slightly, it affects how much you’ll pay month-to-month on your home loan. The chart below shows how it works: In this example, if rates rise to 3.55%, you’ll pay an extra $100 each month on your monthly mortgage payment if you purchase a home around this time next year. That extra money can really add up over the life of a 15 or 30-year loan.

In this example, if rates rise to 3.55%, you’ll pay an extra $100 each month on your monthly mortgage payment if you purchase a home around this time next year. That extra money can really add up over the life of a 15 or 30-year loan.

Clearly, today’s mortgage rates are worth taking advantage of before they climb further. The rates we’re seeing right now give you a unique opportunity to afford more home for your money while keeping your monthly payment down.

Bottom Line

Waiting for a lower mortgage rate could cost you. Experts project rates will continue to rise in the months ahead. Let’s connect so you can seize this opportunity before they increase further.

![What’s Causing Today’s Competitive Real Estate Market? [INFOGRAPHIC] | Simplifying The Market](https://www.sellingthe608.com/wp-content/uploads/2021/10/20211008-MEM.png)