Housing Market Forecasts for the Rest of 2025

If you’ve been watching the market, you’ve likely noticed a few changes already this year. But what’s next? From home prices to mortgage rates, here’s what the latest expert forecasts suggest for the rest of 2025 – and what these shifts could mean for you.

Will Home Prices Fall?

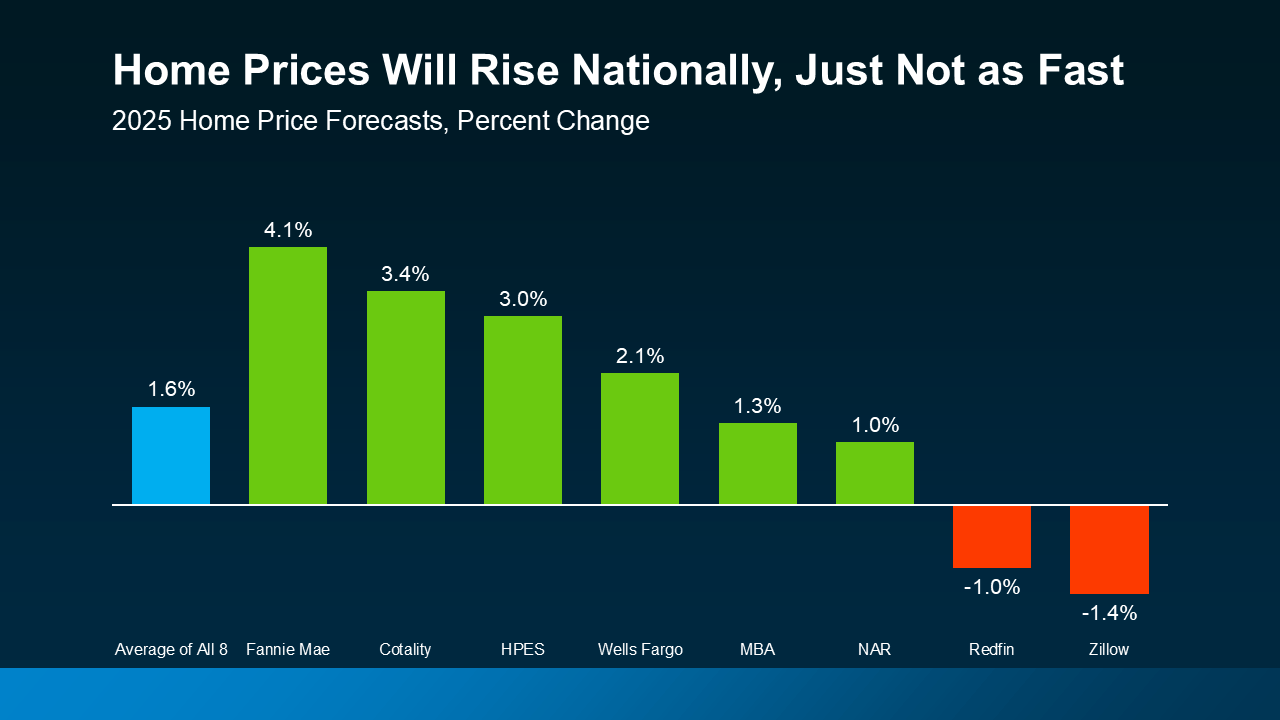

Many buyers are hoping home prices will come down soon. And recent headlines about prices dipping in some areas are making some people believe it’s just a matter of time before there’s a bigger drop. But here are the facts.

While home price growth is slowing down, that doesn’t mean we’re headed for a crash. As NAHB explains:

“House price growth slowed . . . partly due to a decline in demand and an increase in supply. Persistent high mortgage rates and increased inventory combined to ease upward pressure on house prices. These factors signaled a cooling market, following rapid gains seen in previous years.”

But experts say, even with that slowdown, prices will still rise this year at the national level. The average of 8 leading forecasters shows prices are expected to go up 1.5-2% in 2025 (see graph below):

That means, if you’re waiting for a major drop, experts agree that’s just not in the cards.

That means, if you’re waiting for a major drop, experts agree that’s just not in the cards.

Keep in mind, while some markets are already seeing prices come down slightly, the average dip is just -3.5%. That’s a far cry from the nearly 20% decline the market experienced during the 2008 crash.

Plus, those small changes are easily absorbed when you consider how much home prices have climbed over the past few years. Data from the Federal Housing Finance Agency (FHFA) shows prices are up 55% nationally compared to just 5 years ago.

The takeaway? Prices aren’t crashing. They’re expected to keep climbing – just not as quickly these days. And some may argue they’ll be closer to flat by the end of this year. But, again, this is going to vary by market, with some local ups and downs. So, lean on a pro to see the latest price trends for your area.

Will Mortgage Rates Come Down?

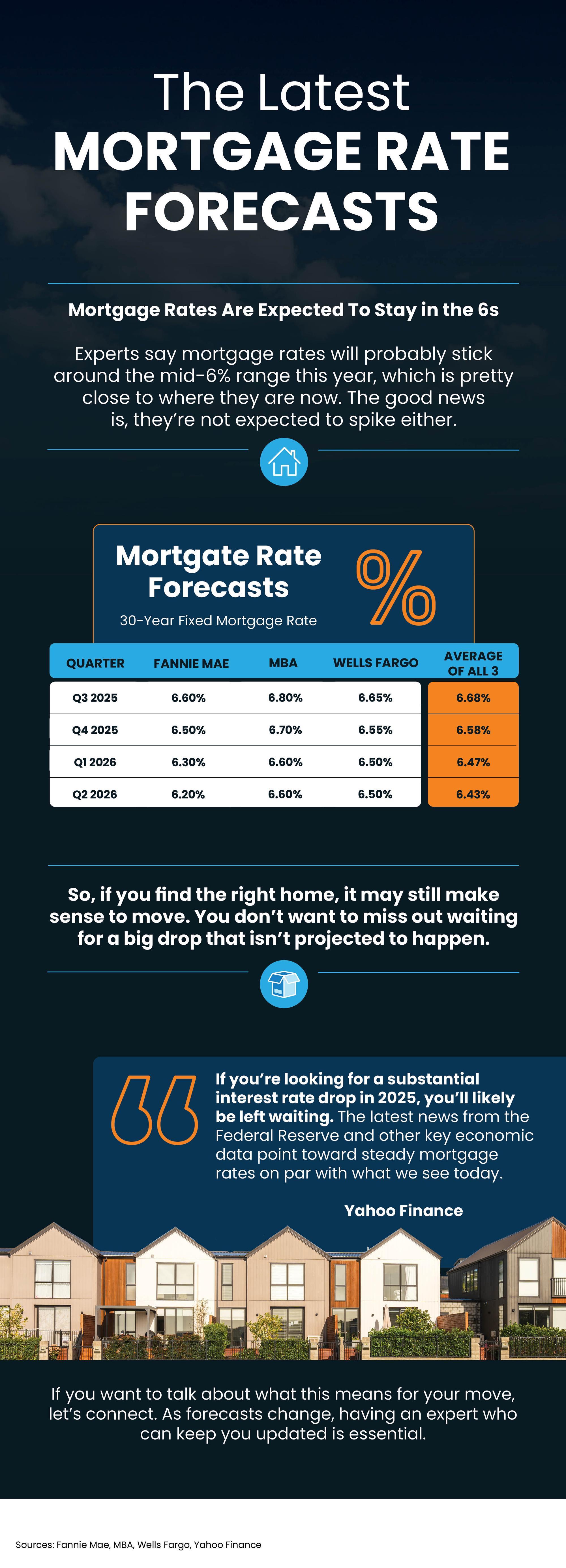

Another common thought among today’s buyers is: I’m just going to wait for rates to come down. But is that a smart strategy? According to Yahoo Finance:

“If you’re looking for a substantial interest rate drop in 2025, you’ll likely be left waiting. The latest news from the Federal Reserve and other key economic data point toward steady mortgage rates on par with what we see today.”

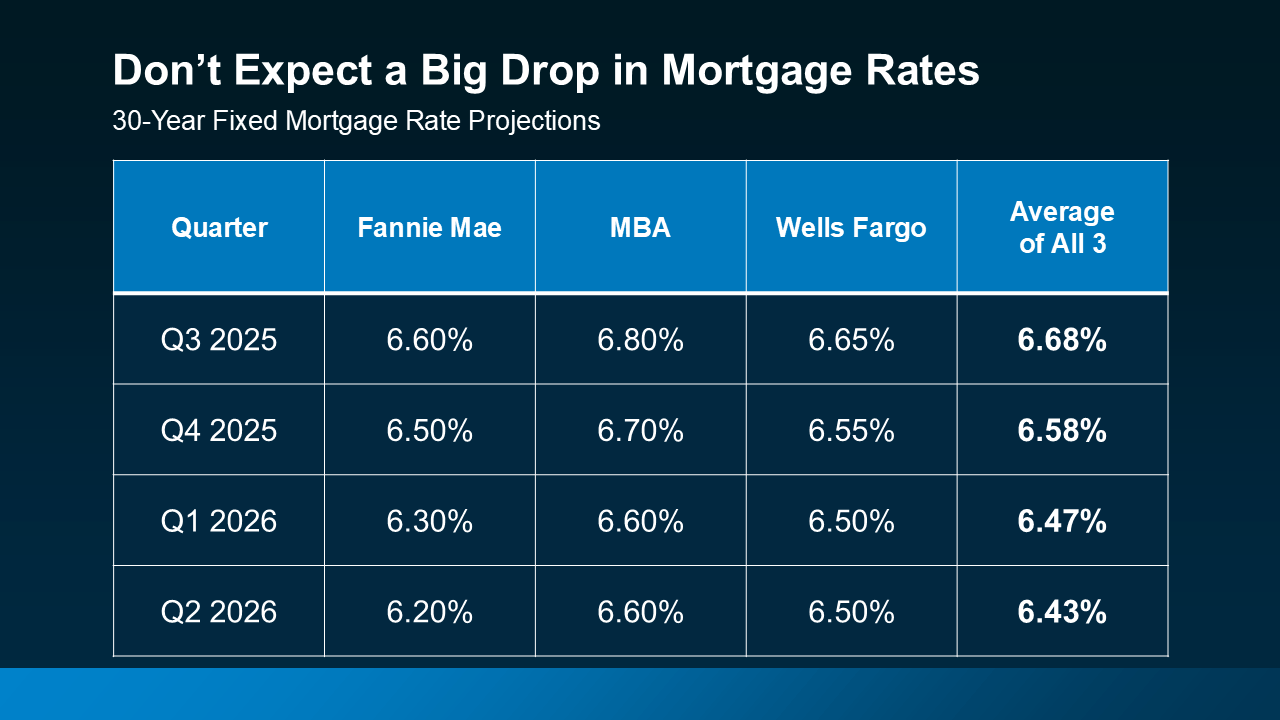

In other words, don’t try to time the market or wait for a drop that may not be coming. Most experts say rates will remain in the 6s, and current projections have them settling in the mid-6% range by the end of this year (see chart below):

And that’s not a big change from where they are right now. So, if you need to move, let’s talk about how to make it happen and what you should watch for. Because while rates may not be as low as you want them to be, you don’t want to put your needs on the back burner, hoping for something the data shows isn’t likely to happen.

And that’s not a big change from where they are right now. So, if you need to move, let’s talk about how to make it happen and what you should watch for. Because while rates may not be as low as you want them to be, you don’t want to put your needs on the back burner, hoping for something the data shows isn’t likely to happen.

Working with an expert who is keeping an eye on all the economic factors that can influence mortgage rates is going to be essential this year. That’s because changes in things like inflation and other key drivers could impact how rates move going forward.

The Takeaway for Buyers and Sellers

Whether you’re buying, selling, or thinking about doing both, this market requires strategy, not guesswork. Prices are still rising nationally (just more slowly), and rates are projected to stay pretty much where they are, so the bigger picture is one of moderation – not a meltdown.

Bottom Line

If you want to make a move, your best bet is to focus on your personal situation – not what the headlines say – and work with a real estate pro who knows how to navigate the shifting conditions in your local market.

Connect with a local agent to go over what’s happening in your area and build a plan that works for you.