The Great Wealth Transfer: A New Era of Opportunity

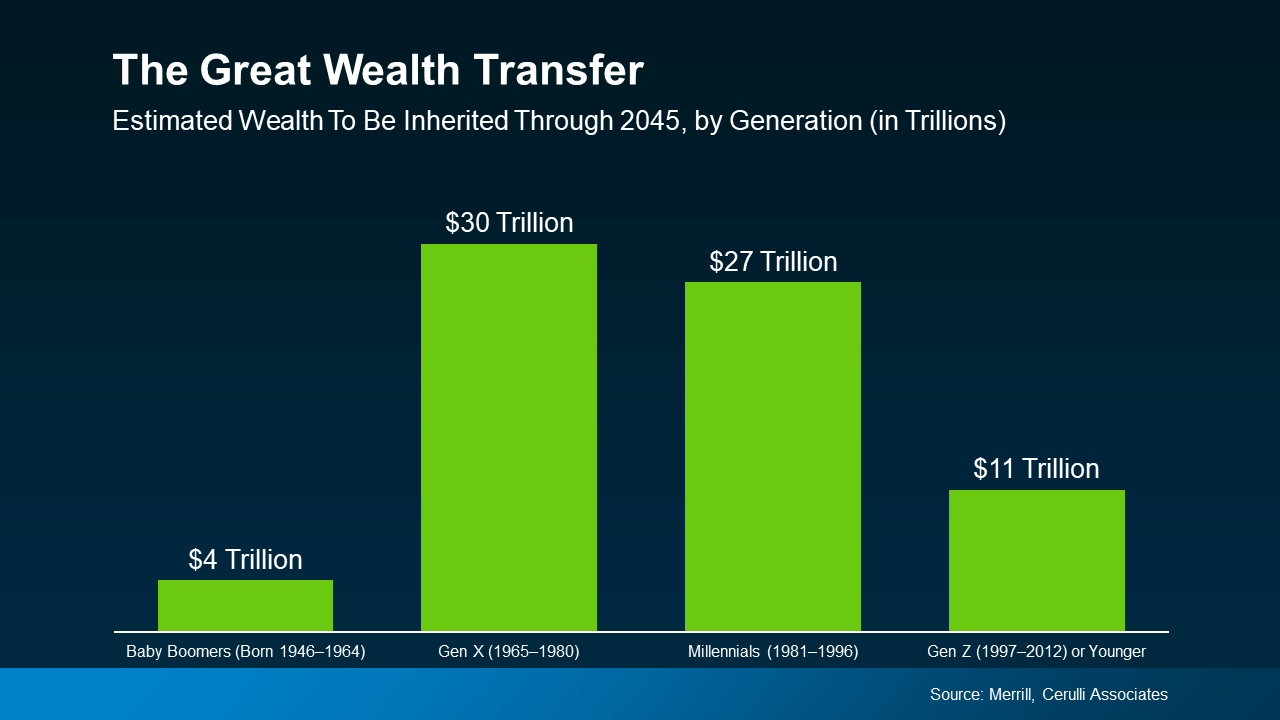

In recent years, there’s been a significant shift in how wealth is distributed among generations. It’s called the Great Wealth Transfer.

Historically, the transfer of wealth from one generation to the next was a more gradual process, often limited to smaller amounts of inheritance or family savings. But today, the scale has increased in a big way. As a recent article from Bankrate says:

“The biggest wave of wealth in history is about to pass from Baby Boomers over the next 20 years, and it’s going to have major impacts on many facets of life. Called The Great Wealth Transfer, $84 trillion is poised to move from older Americans to Gen X and millennials. If it’s managed smartly, Americans will be able to grow their wealth and ensure their financial security.”

Basically, as more Baby Boomers retire, sell businesses, or downsize their homes, more substantial assets are being passed down to younger generations. And this creates a powerful ripple effect that’ll continue over the next few decades. The graph below uses data from Merrill and Cerulli Associates to give you an idea of how much inherited money is set to change hands through 2045:

Impact on the Housing Market

Impact on the Housing Market

One of the most immediate effects of this wealth transfer is on the housing market. Home affordability has been a concern for many aspiring buyers, especially in high-demand areas. The increase in generational wealth is expected to ease some of these challenges by providing future homeowners with greater financial resources. As assets are passed down through generations, buyers may find themselves in a better position to afford homes. Merrill talks about that benefit in a recent article:

“While millennials face steep barriers . . . to buying a first home in many markets, ‘that’s a for-now story, not a forever story’ . . . The Great Wealth Transfer should enable more of them to become homeowners — or trade up or add a second home — either through inherited property or the funds for a down payment.”

Impact on the Economy

But the Great Wealth Transfer doesn’t just impact housing. It’s also going to provide a new avenue for entrepreneurial spirits to fuel economic growth. If someone is looking to start a business and they’re receiving funds like this, that money can used as the necessary capital to start a new company. This helps the next generation of innovators and business owners bring their ideas to life.

Bottom Line

While affordability remains a challenge in today’s housing market, the ongoing Great Wealth Transfer is poised to unlock new opportunities. As wealth is passed down and put to use, it’s expected to ease some of the barriers to homeownership and fuel other entrepreneurial endeavors.

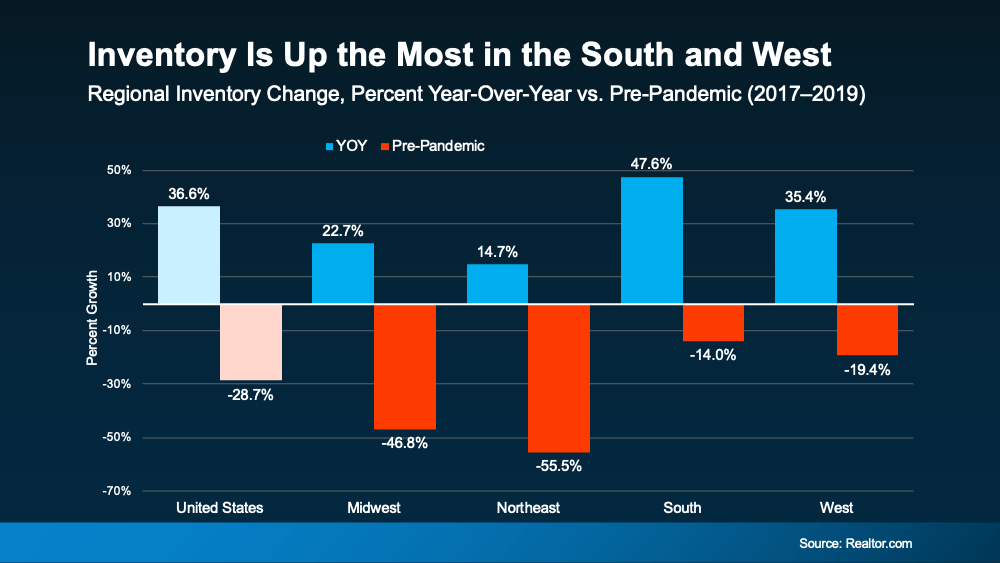

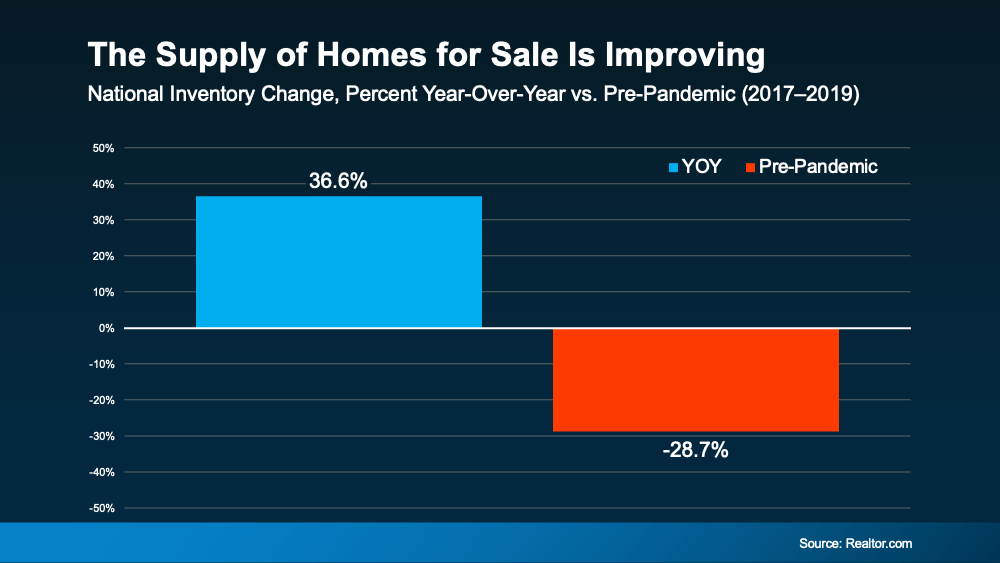

So, while we’re up by almost 37% year-over-year, we’re still not back to how much inventory there’d be in a normal market.

So, while we’re up by almost 37% year-over-year, we’re still not back to how much inventory there’d be in a normal market.