Is January the Best Time To Buy a Home?

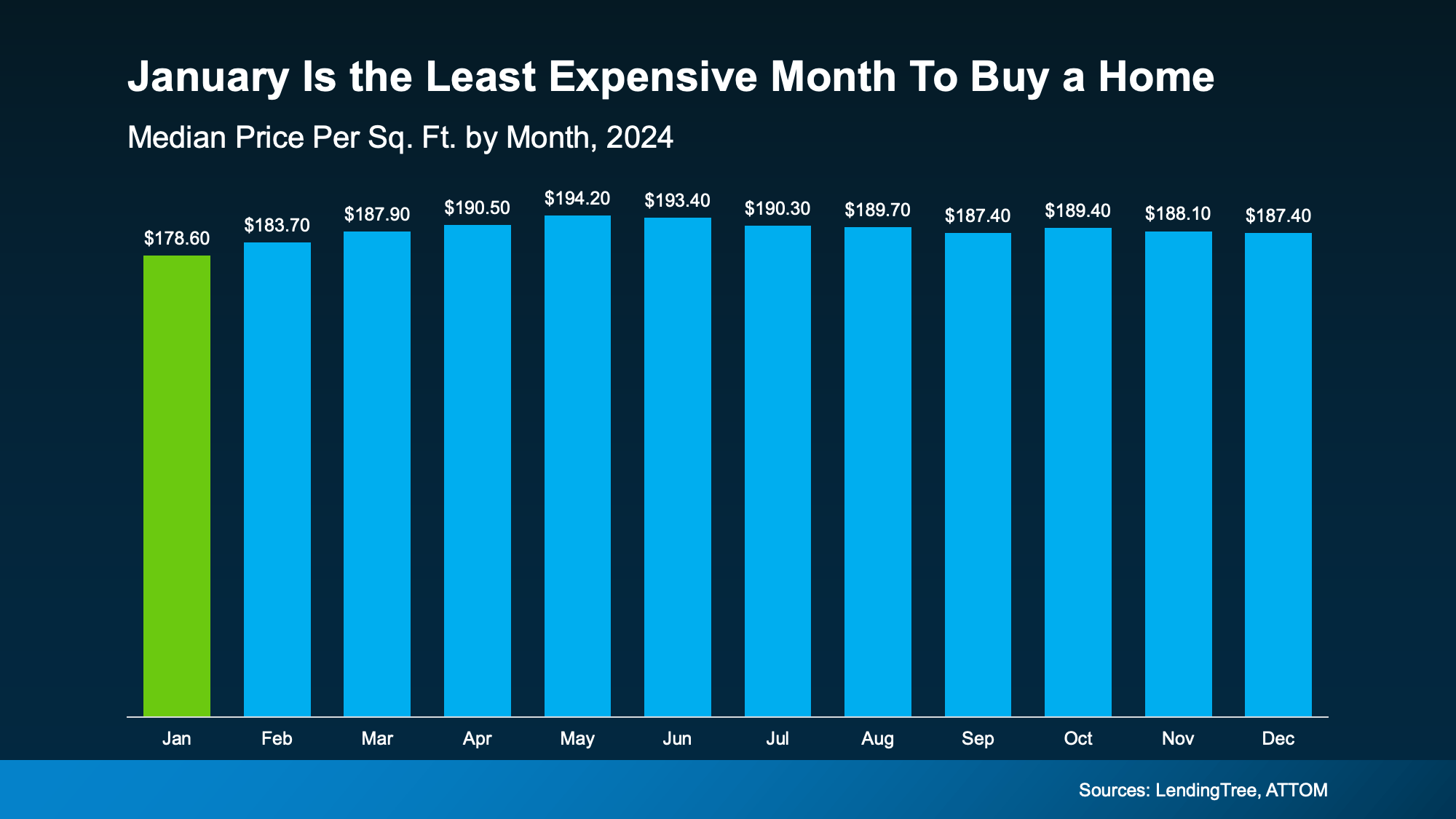

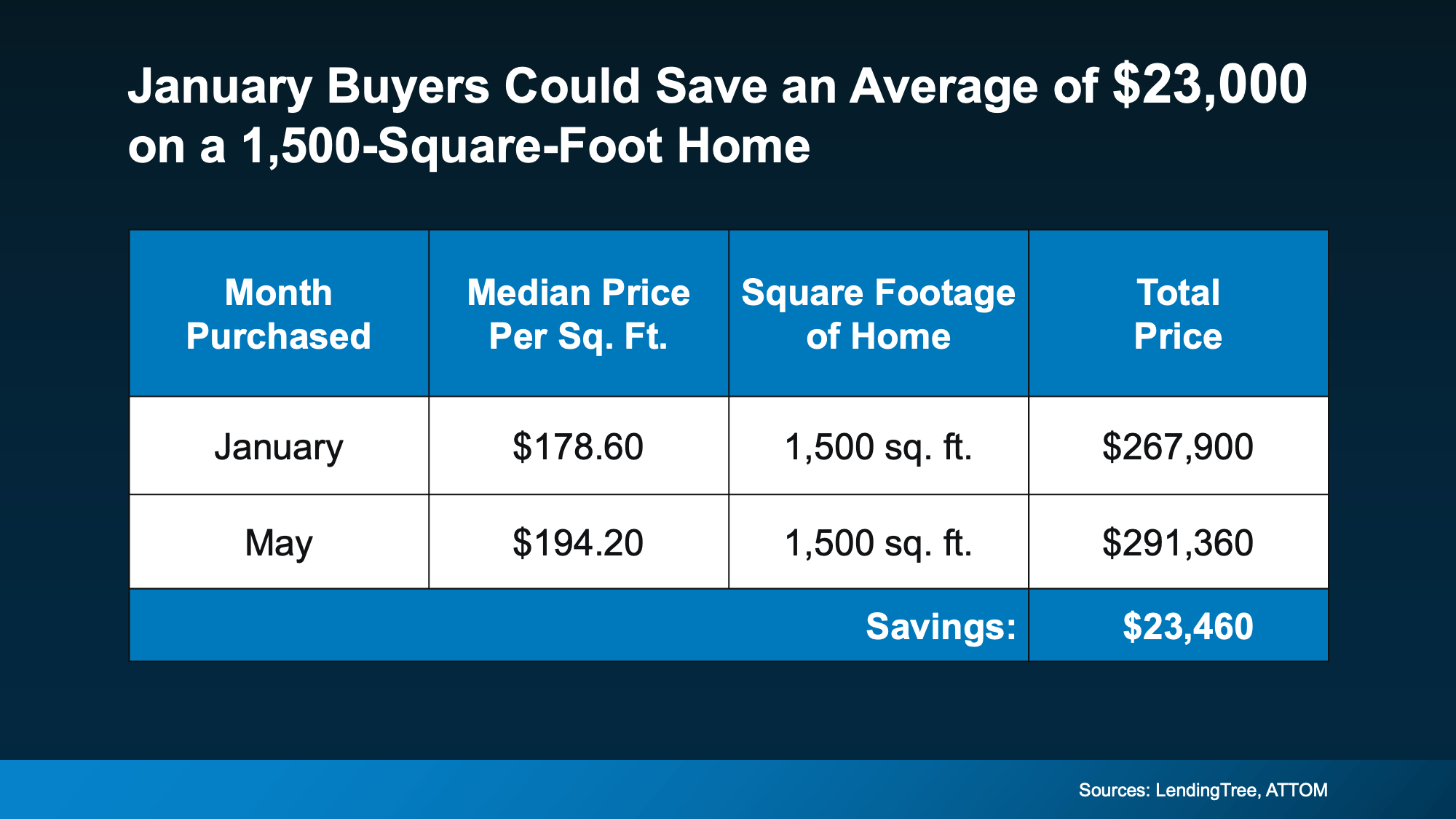

You may not want to put your homebuying plans into hibernation mode this winter. While a lot of people assume spring is the ideal time to buy a house, new data shows January may actually be the best time of year for budget-conscious buyers.

Kind of surprising, right? Here’s why January deserves a serious look.

1. Prices Tend To Be Lower This Time of Year

Lending Tree says January is the least expensive month to buy a home. And there’s something to that. January has historically offered one of the lowest price-per-square-foot points of the entire year. But the spring? That’s when demand (and prices) usually peak. And that’s not speculation – it’s a well-known trend based on years of market data.

So, how much less are we talking? Here’s a look at the numbers. According to the last full year of data, for the typical 1,500 square foot house, buyers who closed on their home in January paid around $23,000 less compared to those who bought in May. And that general trend typically holds true each year (see chart below):

So, how much less are we talking? Here’s a look at the numbers. According to the last full year of data, for the typical 1,500 square foot house, buyers who closed on their home in January paid around $23,000 less compared to those who bought in May. And that general trend typically holds true each year (see chart below):

Now, your number is going to depend on the price, size, and type of the home you’re buying. But the trend is clear. For today’s buyers, it’s meaningful savings, especially when affordability is still tight for so many households.

Now, your number is going to depend on the price, size, and type of the home you’re buying. But the trend is clear. For today’s buyers, it’s meaningful savings, especially when affordability is still tight for so many households.

2. Fewer Buyers and More Motivated Sellers

And why do buyers typically save in the winter? It’s simple. Winter is one of the slowest times in the housing market each year. Both buyers and sellers tend to pull back, thinking it’s better to wait until spring. And that means:

- You face less competition

- You’re less likely to get into a multiple offer scenario

- Sellers are more willing to negotiate (since there aren’t as many buyers)

With fewer buyers in the market, you can take your time browsing.

But winter doesn’t just thin out the pool of buyers, it also reveals which sellers truly need to sell. Because fewer people are house hunting during the colder months, sellers who really need to move tend to be more open to negotiating. As Realtor.com explains:

“Less competition means fewer bidding wars and more power to negotiate the extras that add up: closing cost credits, home warranties, even repair concessions. . . these concessions can end up knocking thousands of dollars off the price of a home.”

This can include everything from price cuts to covering closing costs, adjusting timelines, and more. It doesn’t mean you’ll automatically get discounts on every home. But it does mean you’re more likely to be taken seriously and given room to negotiate.

Should You Wait for Spring?

Here’s the real takeaway. When you remove the pressure and frenzy that comes with the busy spring season, it becomes much easier to get the home you want at a price that fits your budget.

But if you wait until spring, more buyers will be in the market. So, waiting could actually mean you spend more and you’d have to deal with more stress.

Now, only you can decide the right timing for your life, but don’t assume you should wait for warmer weather before you move.

Buying in January gives you: less competition, potentially lower prices, and more motivated sellers. And those are three perks you’re not going to see if you wait until spring.

Bottom Line

If you’ve been thinking about taking the next step, this season might give you more opportunity than you think.

Curious what buying in January could look like for you? Talk to a local agent who can help you take a closer look at your numbers and the homes that are available in your area.

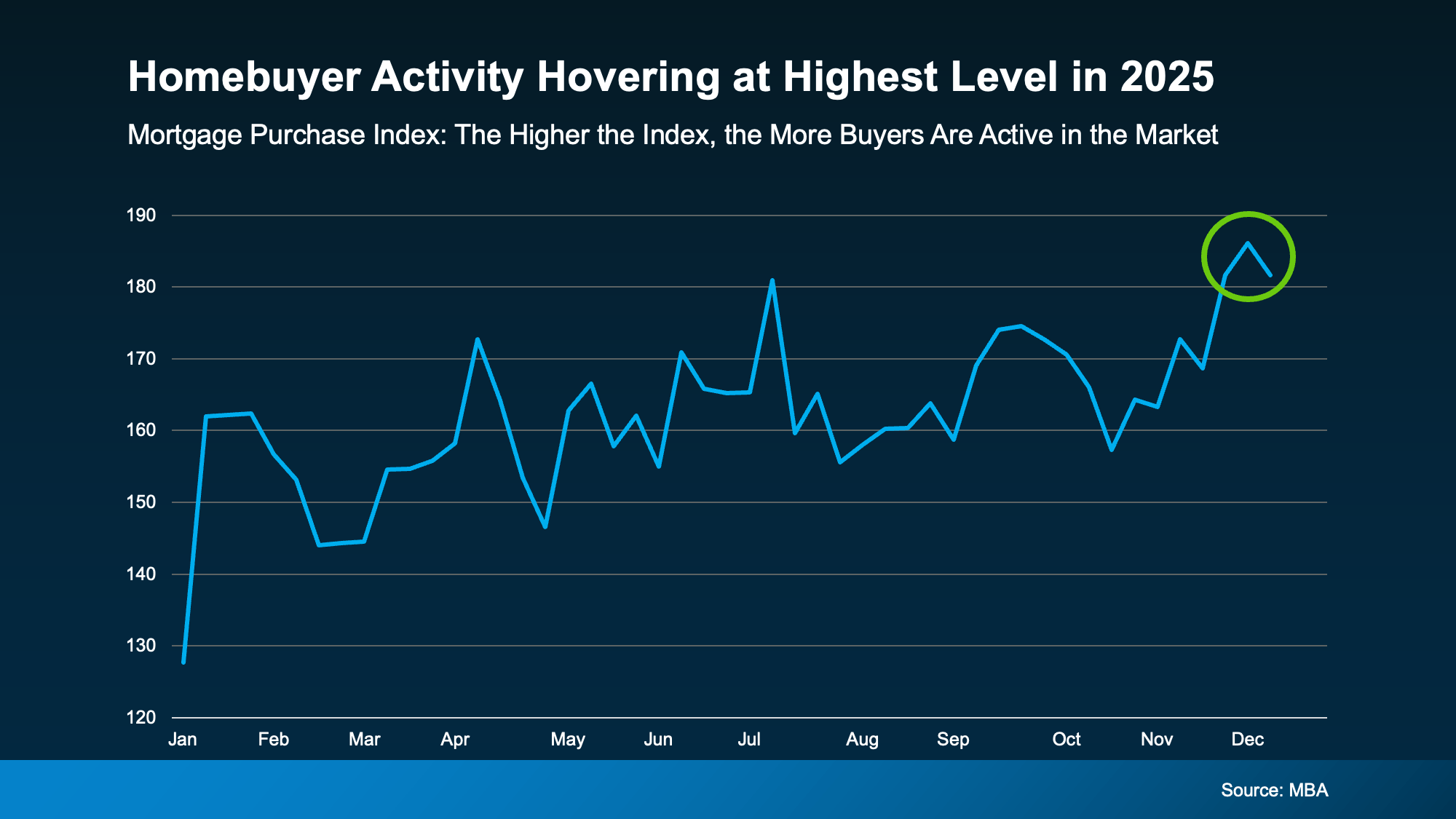

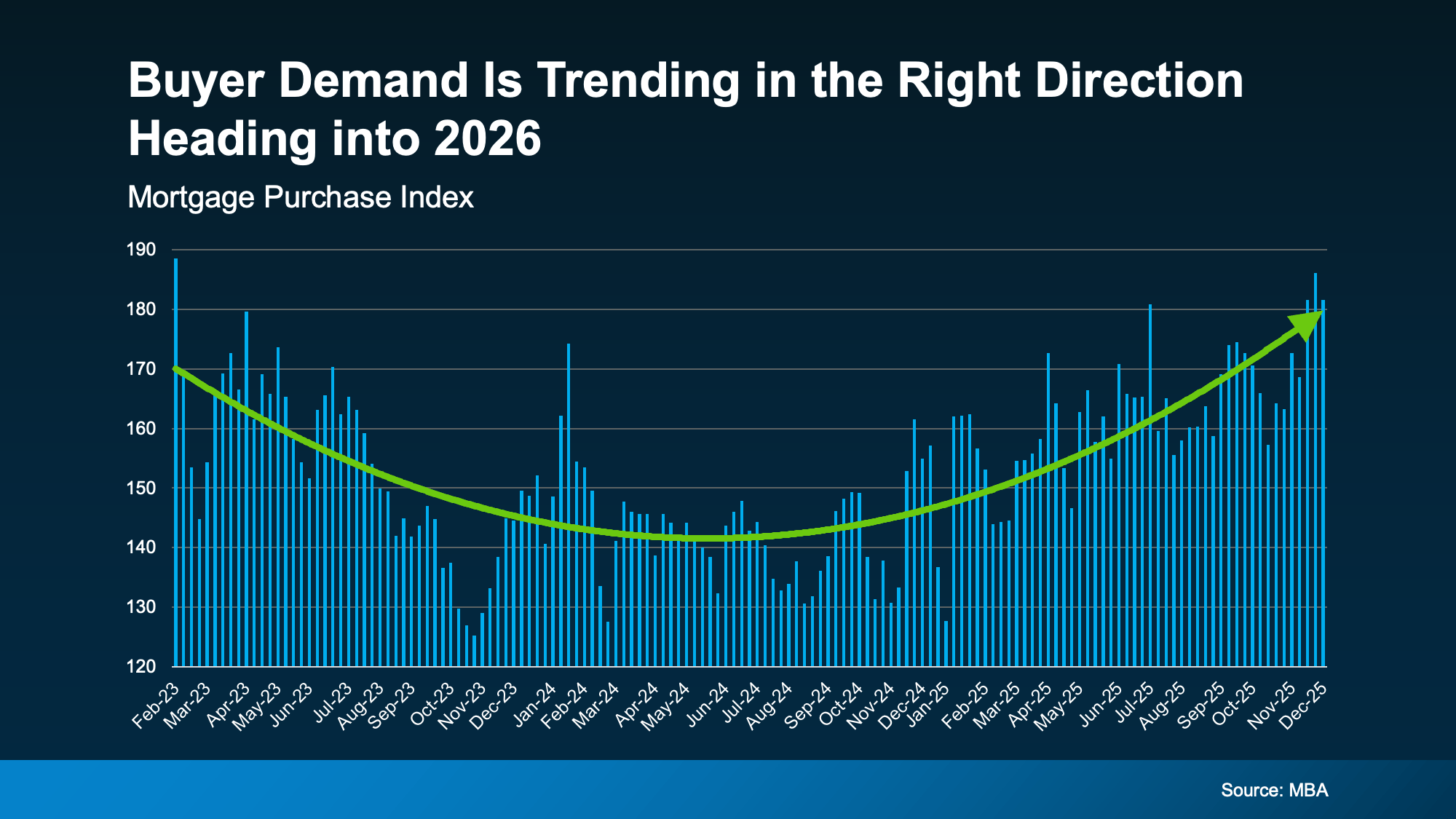

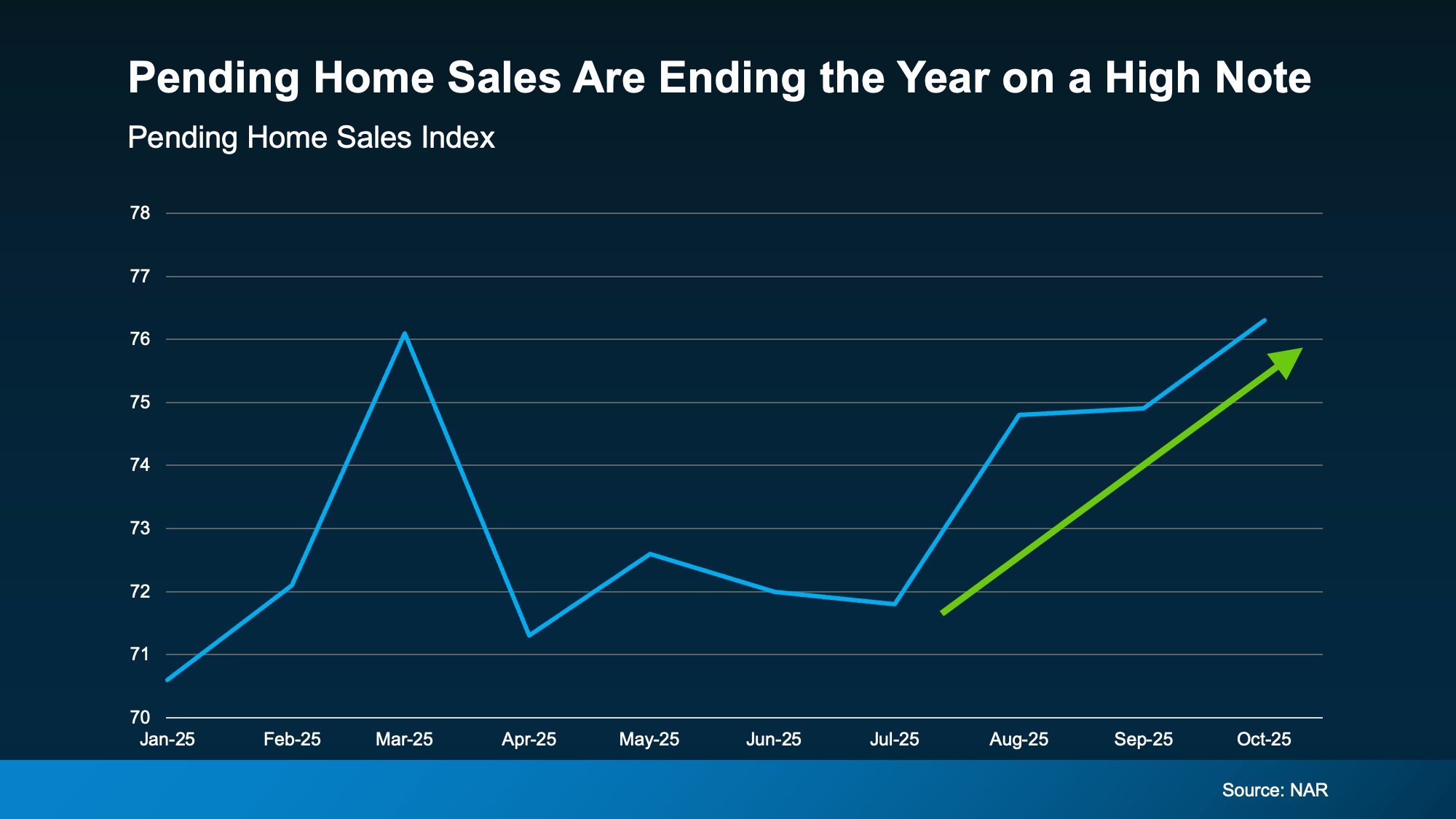

And that means the market is ending the year on a high note and headed into 2026 with renewed energy. While that may not seem like a big shift, it’s a rebound worth talking about.

And that means the market is ending the year on a high note and headed into 2026 with renewed energy. While that may not seem like a big shift, it’s a rebound worth talking about.