Boomers Moving Will Be More Like a Gentle Tide Than a Tsunami

Have you heard the term “Silver Tsunami” getting tossed around recently? If so, here’s what you really need to know. That phrase refers to the idea that a lot of baby boomers are going to move or downsize all at once. And the fear is that a sudden influx of homes for sale would have a big impact on housing. That’s because it would create a whole lot more competition for smaller homes and would throw off the balance of supply and demand, which ultimately would impact home prices.

But here’s the thing. There are a couple of faults in that logic. Let’s break them down and put your mind at ease.

Not All Baby Boomers Plan To Move

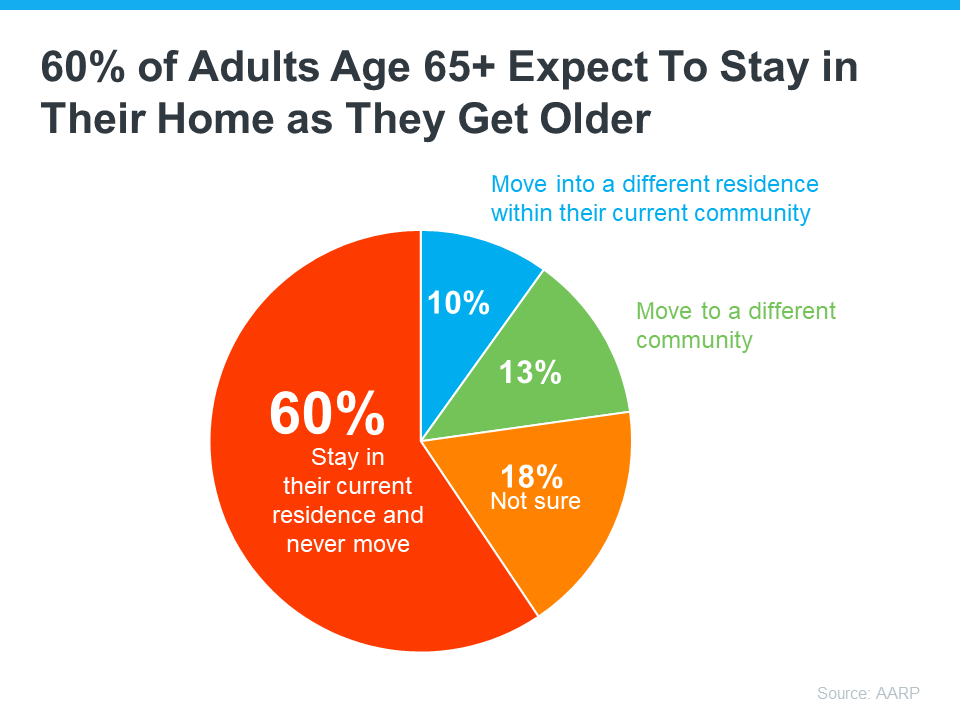

For starters, plenty of baby boomers don’t plan on moving at all. A study from the AARP says more than half of adults aged 65 and older want to stay in their homes and not move as they age (see graph below):

While it’s true circumstances may change and some people who don’t plan to move (the red in the chart above) may realize they need to down the road, the vast majority are counting on aging in place.

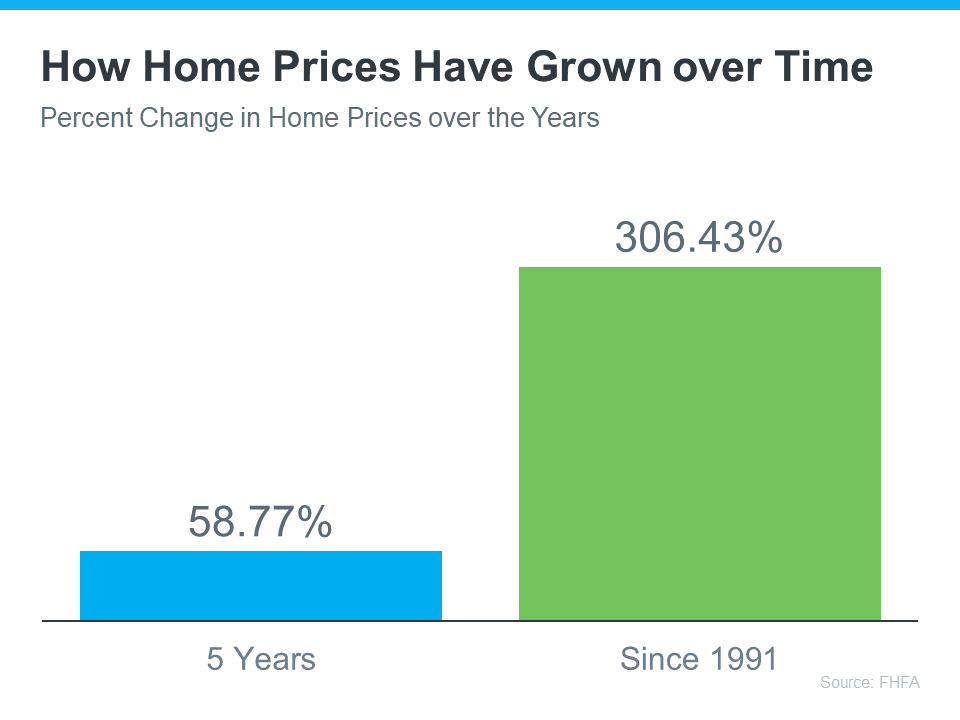

As for those who stay put, they’ll likely modify their homes as their needs change over time. And when updating their existing home won’t work, some will buy a second home and keep their original one as an investment to fuel generational wealth for their loved ones. As an article from Inman explains:

“Many boomers have no desire to retire fully and take up less space . . . Many will modify their current home, and the wealthiest will opt to have multiple homes.”

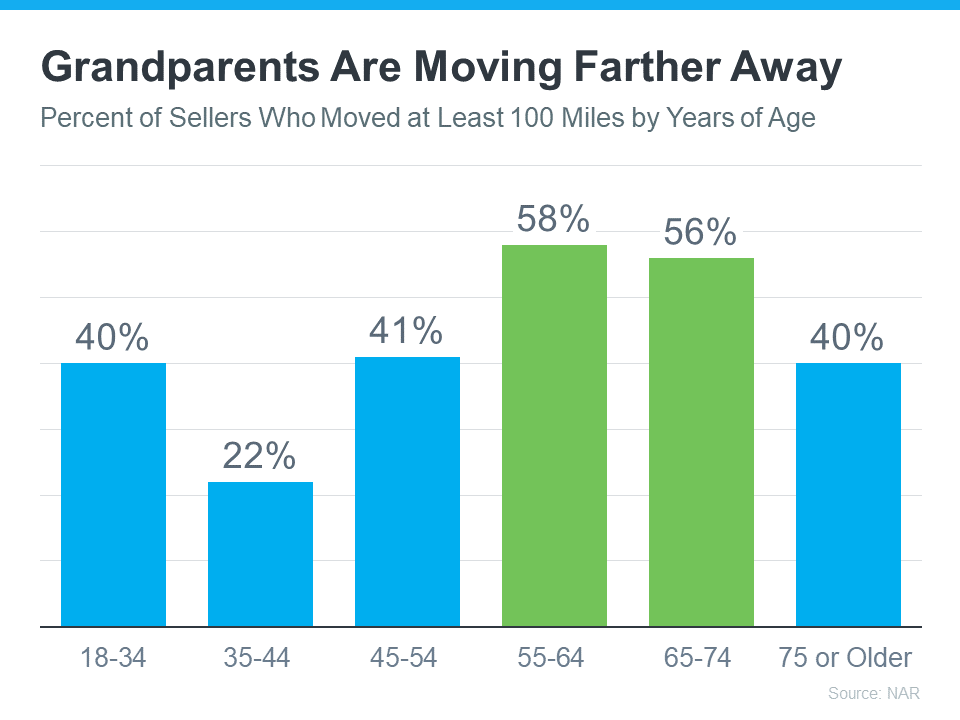

Even Those Who Do Move Won’t Do It All at Once

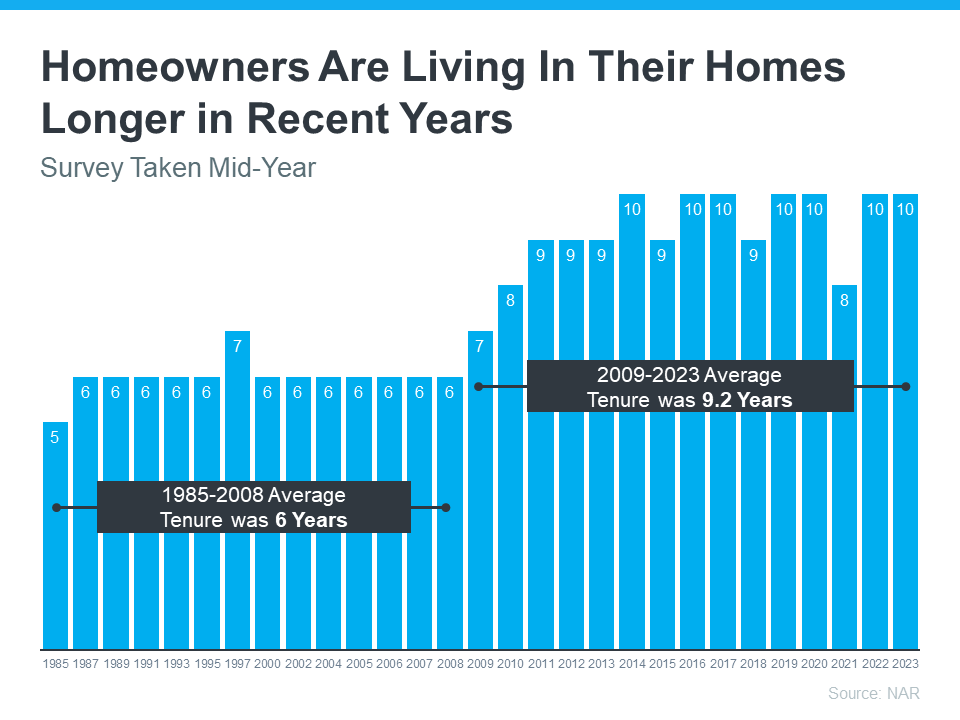

While not all baby boomers are looking to sell their homes and move – the ones who do won’t all do it at the same time. Instead, it’ll happen slowly over many years. As Freddie Mac says:

“We forecast the ‘tsunami’ will be more like a tide, bringing a gradual exit of 9.2 million Boomers by 2035 . . .”

As Mark Fleming, Chief Economist at First American, says:

“Demographics are never a tsunami. The baby boomer generation is almost two decades of births. That means they’re going to take about two decades to work their way through.”

Bottom Line

If you’re stressed about a Silver Tsunami shaking the housing market overnight, don’t be. Baby boomers will move slowly over a much longer period of time.