Is a 20% Down Payment Really Necessary To Purchase a Home?

There’s a common misconception that, as a homebuyer, you need to come up with 20% of the total sale price for your down payment. In fact, a recent survey by Lending Tree asks what is keeping consumers from purchasing a home. For over half of those surveyed, the ability to afford a down payment is the biggest hurdle.

That may be because those individuals assume a 20% down payment is necessary. While putting more money down if you’re able can benefit buyers, putting 20% down is not mandatory. As Freddie Mac puts it:

“The most damaging down payment myth—since it stops the homebuying process before it can start—is the belief that 20% is necessary.”

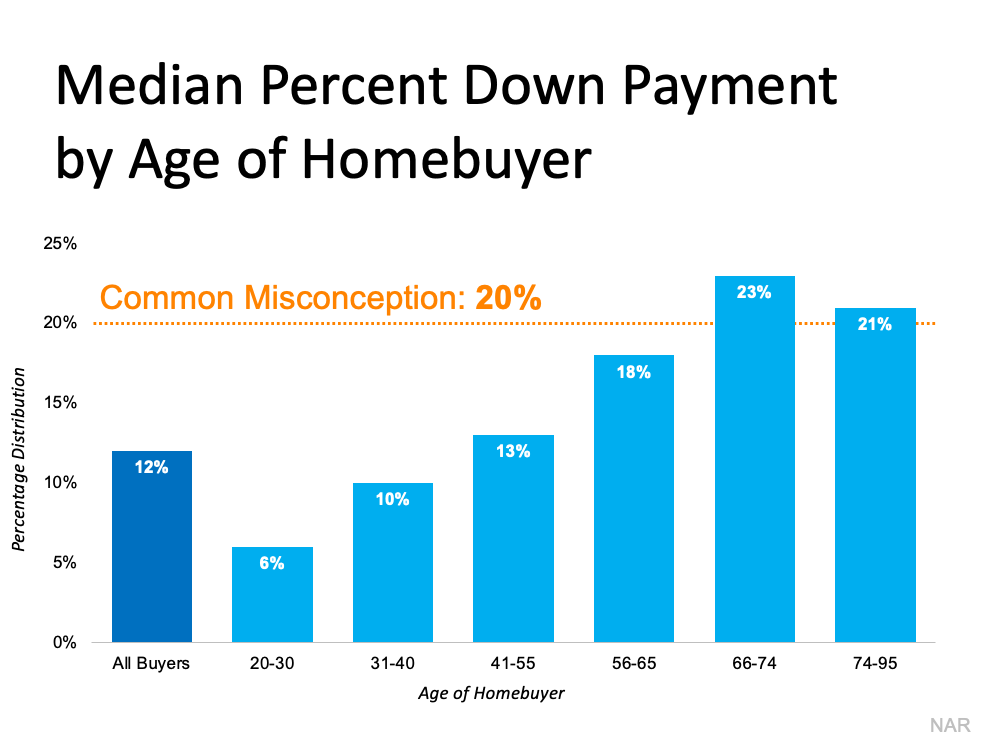

If saving that much money sounds overwhelming, you might be ready to give up on the dream of homeownership before you even begin – but you don’t have to. According to the Profile of Home Buyers and Sellers from the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. It may sound surprising, but today’s average down payment is only 12%. That number is even lower for first-time homebuyers, whose average down payment is only 7%.

Based on the Home Buyers and Sellers Generational Trends Report from NAR, the graph below shows an even closer look at the down payment percentage various age groups pay: As the graph shows, the only groups who put 20% or more down on average are older homebuyers who likely can use the sale of an existing home to fuel a larger down payment on their next home.

As the graph shows, the only groups who put 20% or more down on average are older homebuyers who likely can use the sale of an existing home to fuel a larger down payment on their next home.

What does this mean for you?

If you’re a prospective homebuyer, it’s important to know you don’t have to put the full 20% down. And while saving for any down payment amount may feel like a challenge, keep in mind there are programs for qualified buyers that allow them to purchase a home with a down payment as low as 3.5%. There are also options like VA loans and USDA loans with no down payment requirements for qualified applicants.

To understand your options, you do need to do your homework. If you’re interested in learning more about down payment assistance programs, information is available through sites like downpaymentresource.com. Be sure to also work with a real estate advisor from the start to learn what you may qualify for in the homebuying process.

Bottom Line

Don’t let the myth of the 20% down payment halt your homebuying process before it begins. If you want to purchase a home this year, let’s connect to start the conversation and explore your options.