Think It’s Better To Wait for a Recession Before You Move? Think Again.

Fear of a recession is back in the headlines. And if you’re thinking about buying or selling sometime soon, that may leave you wondering if you should reconsider the timing of your move.

A recent survey by John Burns Research and Consulting (JBREC) and Keeping Current Matters (KCM) shows 68% of people are delaying plans to buy or sell due to economic uncertainty.

But it may not be for the reason you think. Not everyone is holding off because they’re worried. Some buyers are waiting because they’re hopeful. According to Realtor.com:

“In 2025Q1, 3 in 10 (29.8% of) surveyed homebuyers said a recession would make them at least somewhat more likely to purchase a home . . . This reflects a common dynamic where some buyers see a downturn as an opportunity. If the economy enters a recession, the Federal Reserve may respond by lowering interest rates to stimulate activity, potentially putting downward pressure on mortgage rates and easing affordability concerns. As a result, buyers—especially those with limited down payments—might view a recession as a more favorable time to enter the market.”

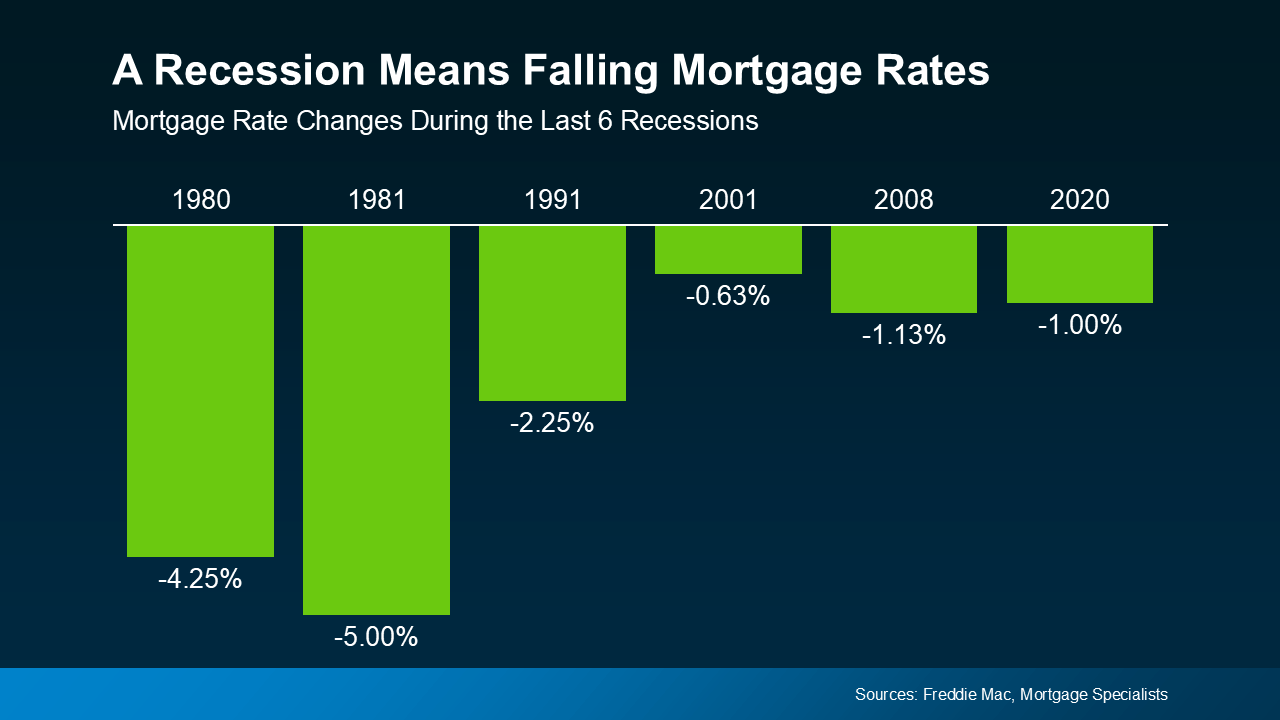

And there’s some truth to the idea that a recession could bring about lower mortgage rates. History shows mortgage rates usually drop during economic slowdowns. That’s not guaranteed – but it is a common pattern. Looking at data from the last six recessions, you can see mortgage rates fell each time (see graph below):

But here’s what those buyers may not be considering. Many of those hopeful buyers are assuming something else will happen too – that home prices will drop. And that’s where history tells a different story.

But here’s what those buyers may not be considering. Many of those hopeful buyers are assuming something else will happen too – that home prices will drop. And that’s where history tells a different story.

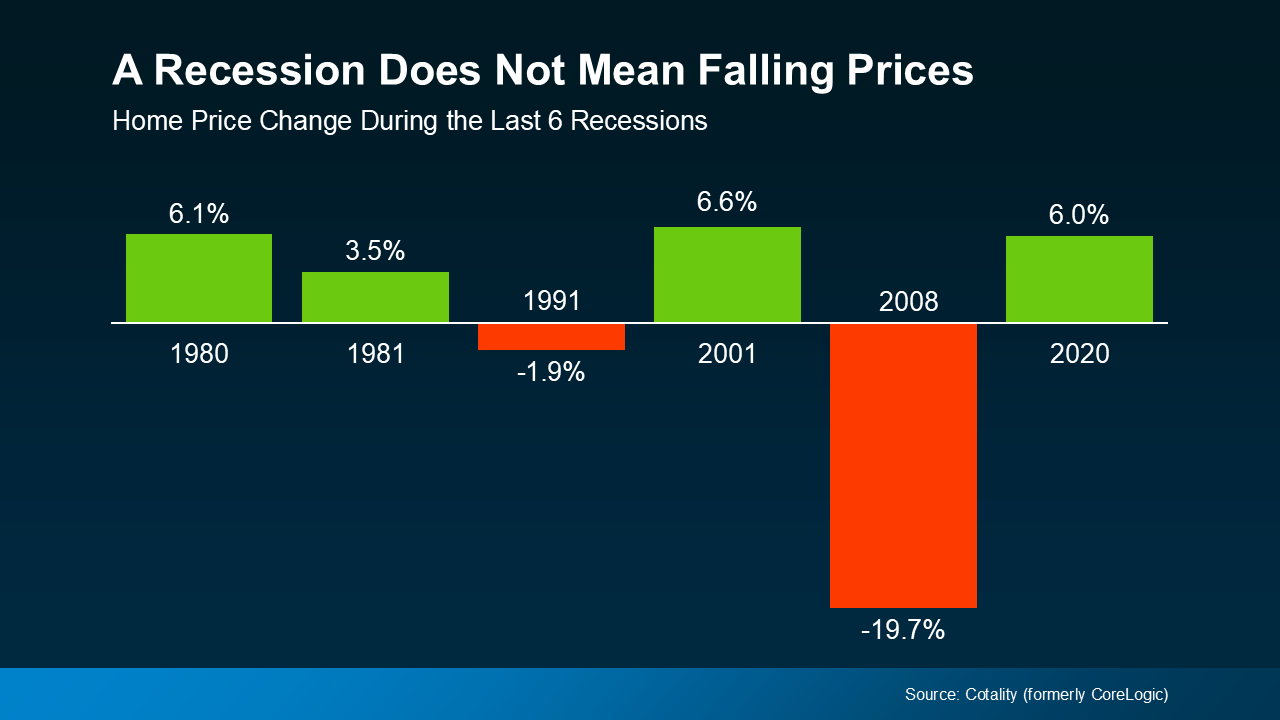

According to data from Cotality (formerly CoreLogic), home prices went up in four of the last six recessions (see graph below)

So, while many people think that if a recession hits, home prices will fall like they did in 2008, that was an exception, not the rule. It was the only time the market saw such a steep drop in prices. And it hasn’t happened since, mainly because there’s still a long-standing inventory deficit, even as the number of homes on the market is rising.

So, while many people think that if a recession hits, home prices will fall like they did in 2008, that was an exception, not the rule. It was the only time the market saw such a steep drop in prices. And it hasn’t happened since, mainly because there’s still a long-standing inventory deficit, even as the number of homes on the market is rising.

Since prices tend to stay on whatever path they’re already on, know this: prices are still holding steady or rising in most metros, although at a much slower pace. So, a big drop isn’t likely. As Robert Frick, Corporate Economist with Navy Federal Credit Union, explains:

“Hopes that an economic slowdown will depress housing prices are wishful thinking at this point . . .”

Bottom Line

If you’ve been waiting for a recession to make your move, it’s important to understand what really happens during one – and what likely won’t. Lower mortgage rates could be on the table. But lower home prices? That’s far less likely.

Don’t wait for a market that may never come. If you’re thinking about buying or selling, connect with an agent to talk through what today’s economy really means for you – and make a smart plan that works in your favor, regardless of what the headlines say.

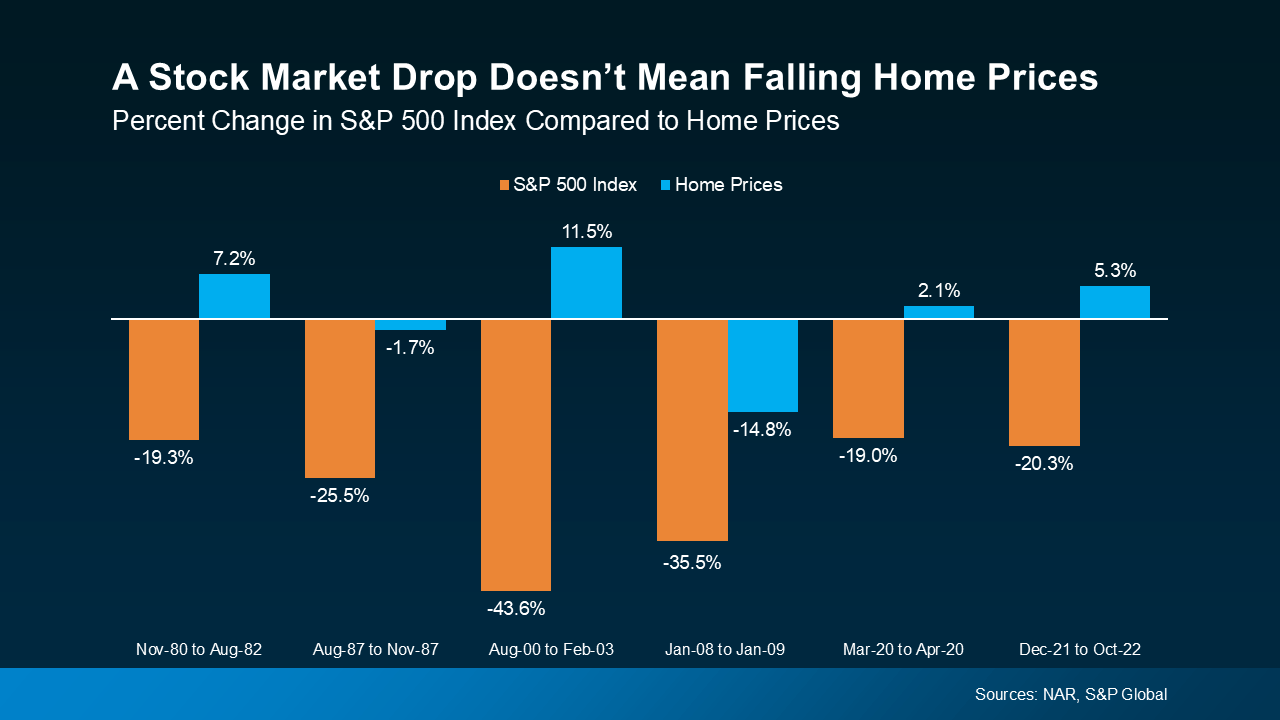

Even when the stock market falls more substantially, home prices don’t always come down with it.

Even when the stock market falls more substantially, home prices don’t always come down with it.