Do You Think the Housing Market’s About To Crash? Read This First

Lately, it feels like a lot of people have been asking the same question: “Is the housing market about to crash?”

If you’ve been scrolling through social media or watching the news, you might have seen some pretty scary headlines yourself. That’s why it’s no surprise that, according to data from Clever Real Estate, 70% of Americans are worried about a housing crash in 2025.

But before you hit pause on your plans to buy or sell a home, take a deep breath. The truth is: the housing market isn’t about to crash – it’s just shifting. And that shift actually works in your favor.

Today’s Inventory Keeps the Housing Market from Crashing

Mark Fleming, Chief Economist at First American, says:

“There’s just generally not enough supply. There are more people than housing inventory. It’s Econ 101.”

Think about it. If there’s a shortage of something – like tickets to a popular concert – prices go up. That’s what’s been happening with homes. We still have a shortage of supply. Too many buyers and not enough homes push prices higher.

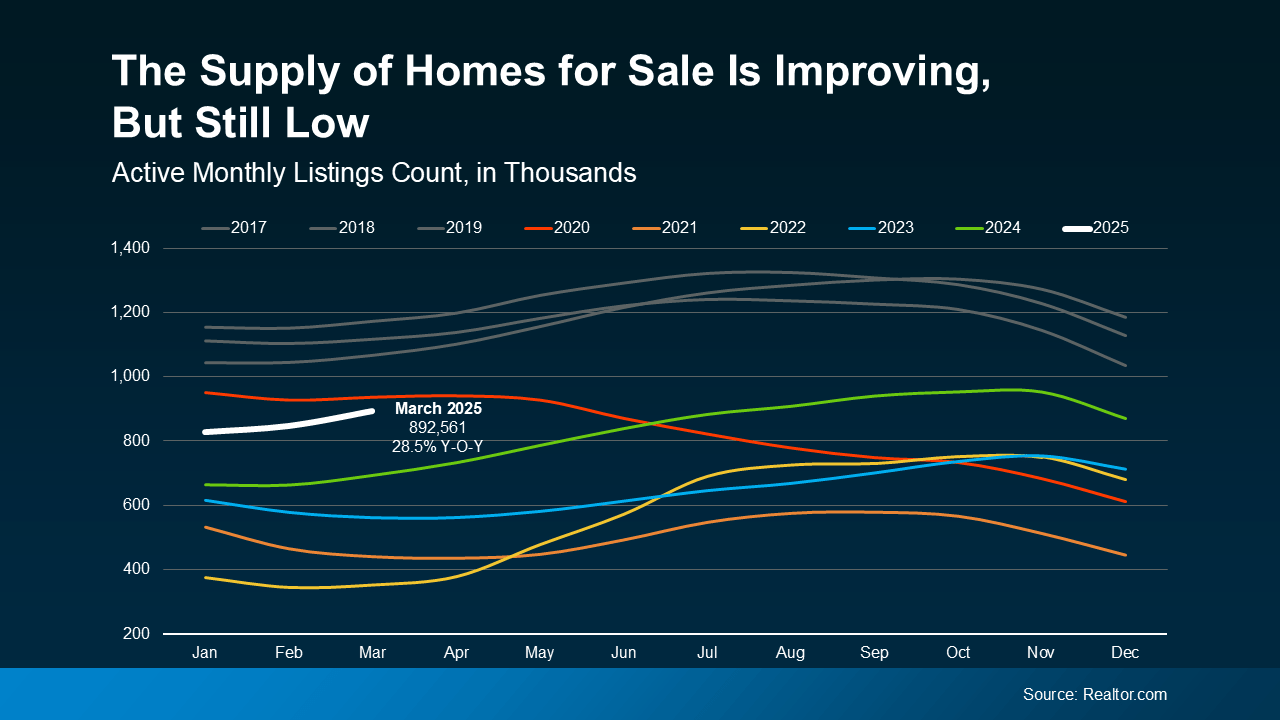

Check out the white line for 2025 in the graph below. Even though the number of homes for sale is climbing, data from Realtor.com shows we’re still well below normal levels (shown in gray):

That ongoing low supply is what’s stopping home prices from dropping at the national level. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

That ongoing low supply is what’s stopping home prices from dropping at the national level. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“… if there’s a shortage, prices simply cannot crash.”

More Homes for Sale Means Price Growth Is Easing

And, as more homes become available, that takes some of the intense upward pressure off home price growth – leading to healthier price appreciation.

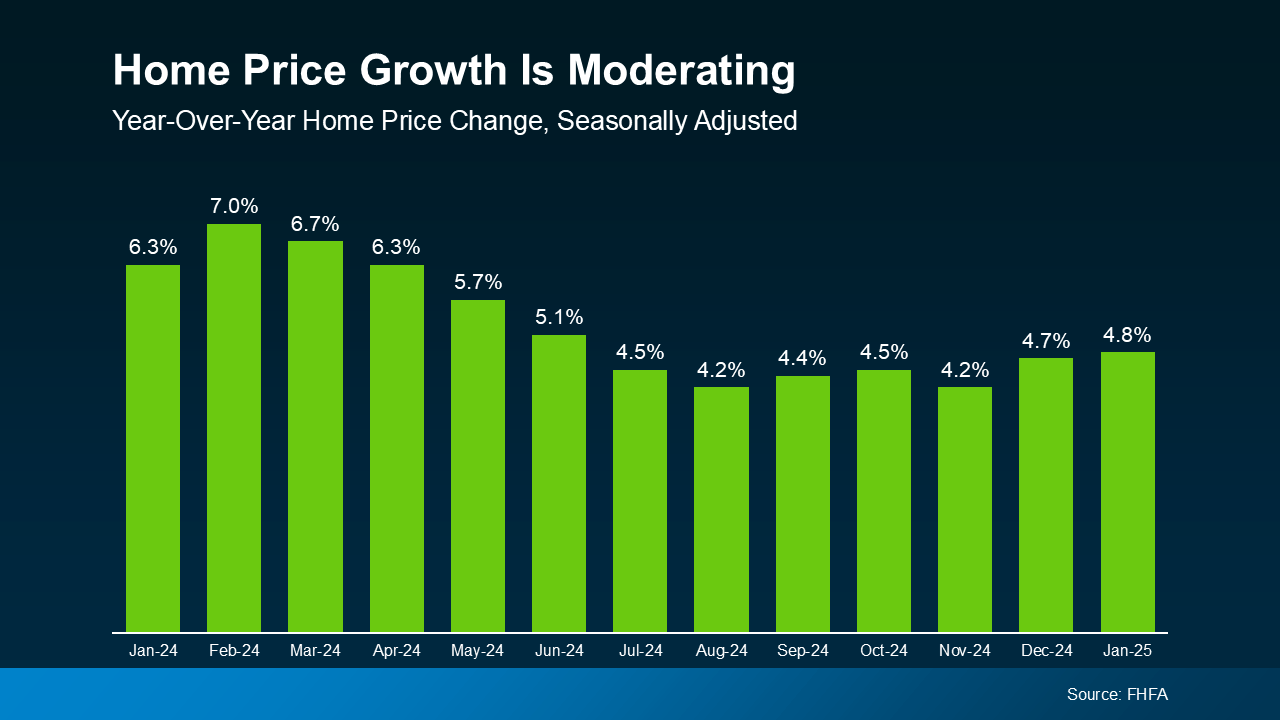

So, while prices aren’t falling nationally, growing inventory means they also aren’t rising as fast as they were. What we’re seeing is price moderation (see graph below):

And according to Freddie Mac, that moderation should continue through the rest of this year:

And according to Freddie Mac, that moderation should continue through the rest of this year:

“In 2025, we expect the pace of house price appreciation to moderate from the levels seen in 2024, while still maintaining a positive trajectory.”

Put simply, that means prices will continue going up in most areas, just not as quickly. That’s good news for anyone who’s been having trouble finding a home and feeling sticker shock from the rapid price appreciation of the past few years.

But of course, what’s happening with prices and inventory is going to vary by local market. So, talk to your agent to find out what’s happening where you live.

Bottom Line

Don’t let the talk scare you. Experts agree that a housing market crash is unlikely in 2025. As Business Insider reports:

“. . . economists who study housing market conditions generally do not expect a crash in 2025 or beyond unless the economic outlook changes.”

Instead, we’re heading into a housing market that’s healthier and more balanced, with slower price growth and more opportunity.

Chat with a local real estate agent about what’s happening in your local market and how you can make the most of it.