The Real Benefits of Buying a Home This Year

Have you been wondering whether you should keep renting or finally make the leap into homeownership? It’s a big decision, and let’s be real — renting can feel like the easier option, especially if buying a home feels out of reach.

But here’s the thing: a recent report from Bank of America highlights that 70% of prospective buyers fear the long-term consequences of renting, including not building equity and dealing with rising rents.

Maybe you’re feeling that too — concerned about where renting might leave you down the road, but still unsure if you’d even be able to buy right now. The truth is, if you’re able to make the numbers work, buying a home has powerful long-term financial benefits.

Let’s break down why homeownership is worth considering in 2025 and beyond, and how it can help set you up for the future.

Buying Builds Wealth Over Time

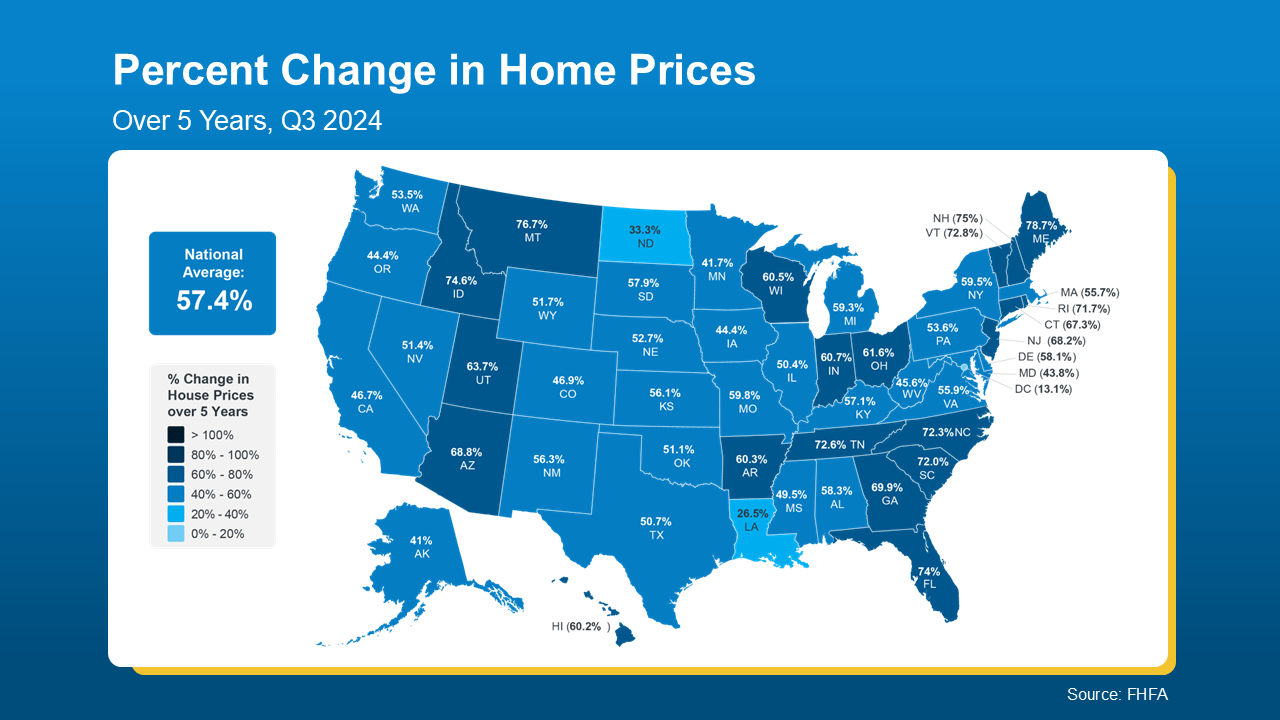

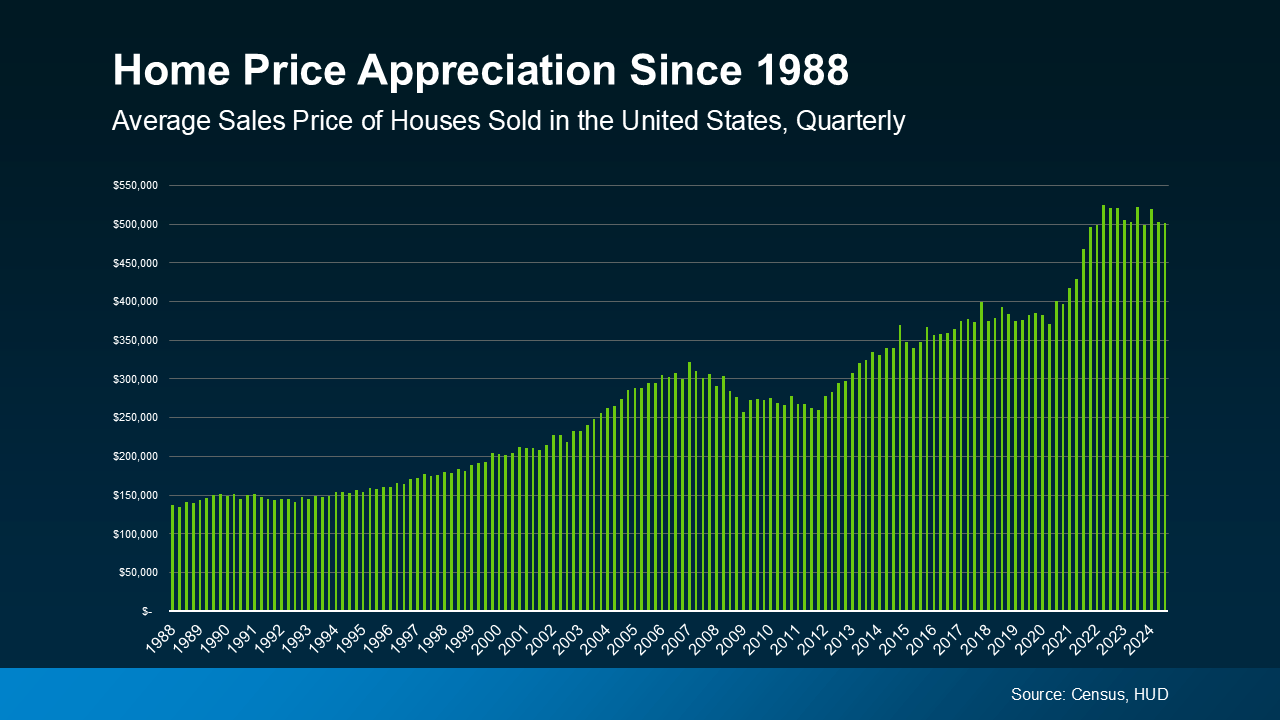

Buying a home allows you to turn your monthly housing costs into a long-term investment. That’s because, as shown in data from the Census and the Department of Housing and Urban Development (HUD), home prices tend to increase over time (see graph below):

Rising home prices directly benefit homeowners. That’s because when you own a home, you build equity — meaning your ownership stake in your home grows as you pay down your mortgage and your home’s value appreciates. And that, in turn, makes your net worth grow too.

Rising home prices directly benefit homeowners. That’s because when you own a home, you build equity — meaning your ownership stake in your home grows as you pay down your mortgage and your home’s value appreciates. And that, in turn, makes your net worth grow too.

Maybe that’s why, according to the National Association of Realtors (NAR), 79% of buyers believe owning a home is a good financial investment.

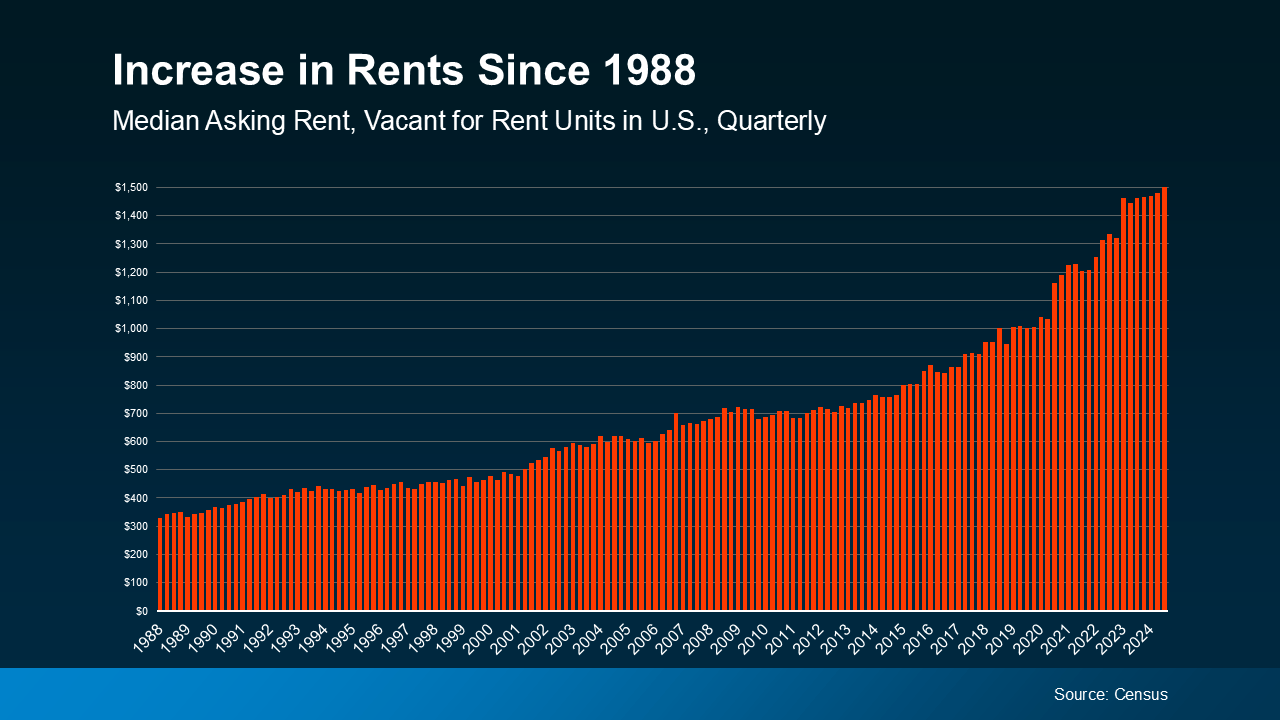

Renting Comes with Rising Costs

Renting may feel more affordable in the short term, especially right now with today’s home prices and mortgage rates. But the reality is, over time, rent almost always goes up too. Take a look at the data and you can see that play out. According to Census data, rents have significantly increased over the decades (see graph below):

This means if you decide to rent, you’ll likely face growing expenses each time you renew or sign a new lease – and that’ll happen without building any wealth in return. Plus, those rising costs may make it harder to save up to buy a home down the road.

This means if you decide to rent, you’ll likely face growing expenses each time you renew or sign a new lease – and that’ll happen without building any wealth in return. Plus, those rising costs may make it harder to save up to buy a home down the road.

Renting vs. Buying: The Long-Term Impact

When you own a home, your payments are an investment in your future. Renting, on the other hand, means your money is gone for good — it helps your landlord build equity, not you.

Renting works for those not ready (or able) to buy today. But if you are able to make the numbers work, buying a home builds equity and sets you up for long-term financial success. So, even though renting may seem easier now, it can’t match the benefits of homeownership.

Bottom Line

If you can afford it, take control of your financial future by making homeownership part of your plan. It’s an investment you won’t regret.

Do you want to see what starter homes are available in your market? Connect with a local real estate agent today to explore your options.