Why Buyers and Sellers Face Very Different Conditions Today

There’s a new divide in housing right now. In some states, buyers are gaining ground. In others, sellers still have the upper hand. It all depends on where you live. Curious what’s happening in your state?

These 3 maps show how the split is playing out across the country. In each one:

- Darker Shades of Blue = Buyer friendly

- Lighter Shades of Blue = Seller strong

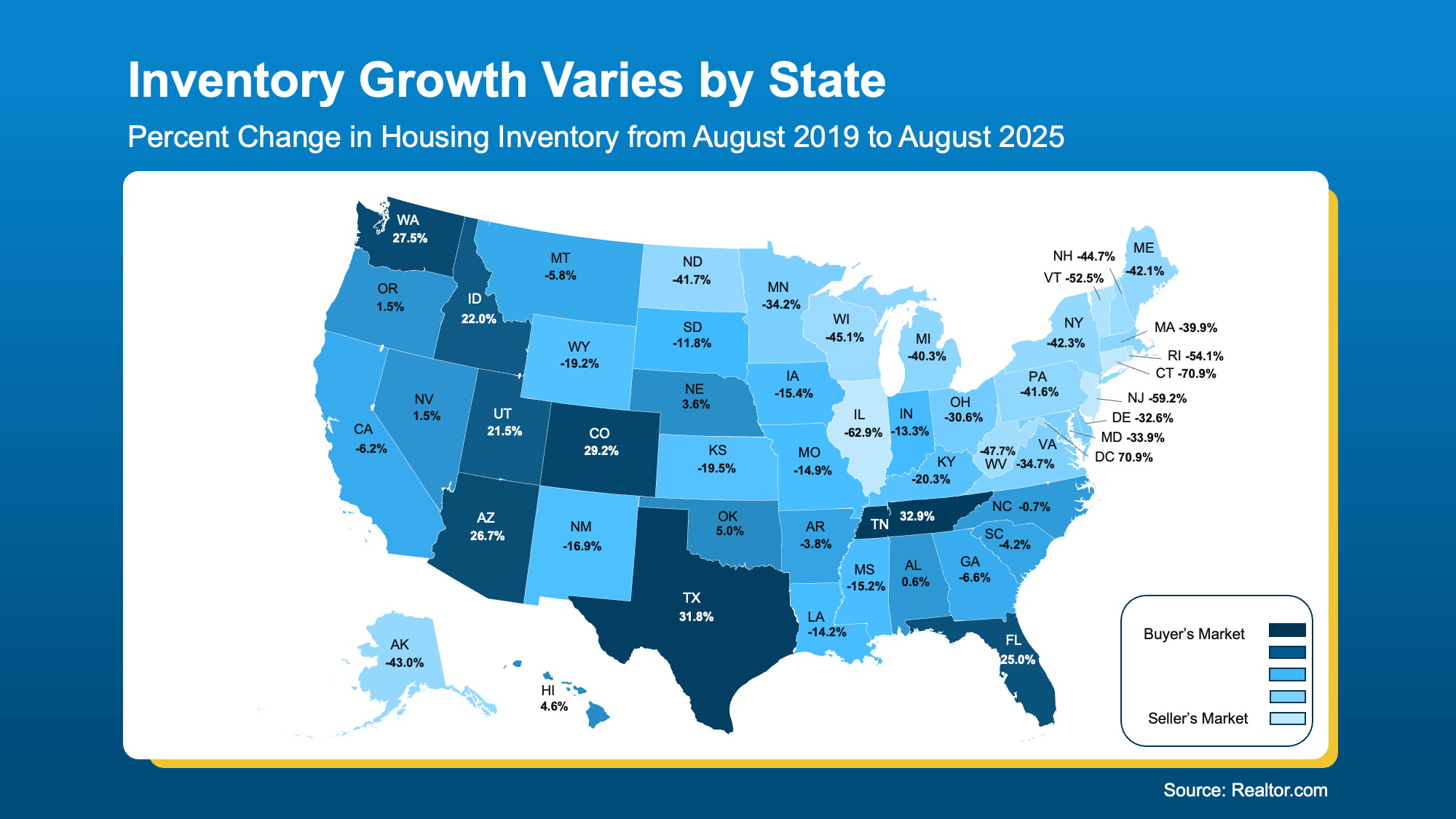

Inventory Sets the Stage

While the number of homes for sale has improved pretty much across the board, how much growth we’ve seen can look dramatically different based on where you live. And that impacts who has the leverage today.

This map uses data from Realtor.com to break it down:

- The darker shades of blue show where inventory has risen more than in other areas of the country. Buyers here have more to choose from and should have an easier time finding a home and leveraging their negotiating power.

- The lighter shades of blue are where inventory is still low. Sellers are more likely to sell quickly and make fewer concessions.

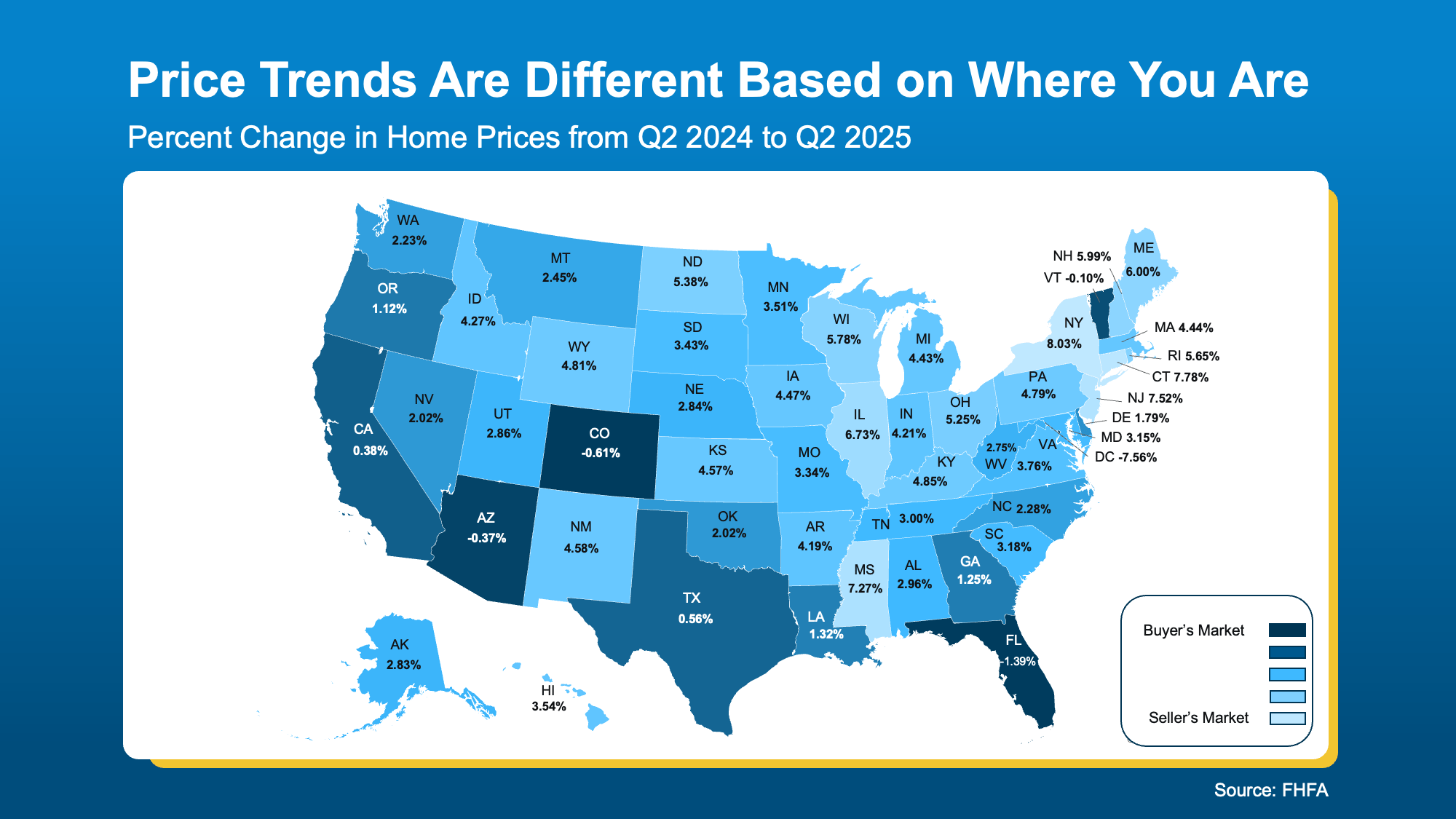

Prices Follow Inventory

Prices Follow Inventory

The second map tracks how home prices are shifting by state. Just like above, you can see the divide taking shape. Many of the same areas are darker blue. That’s because there’s such a close tie between inventory and prices. When inventory rises, prices moderate.

- The darker shades of blue are where prices are actually coming down slightly or flattening. Because, with more homes for sale, sellers may have to cut their price or throw in concessions to get a deal done. And that benefits budget-conscious buyers.

- The lighter shades of blue show areas where prices are still climbing because inventory is low. Sellers may still see buyers competing for homes, and that pushes prices higher.

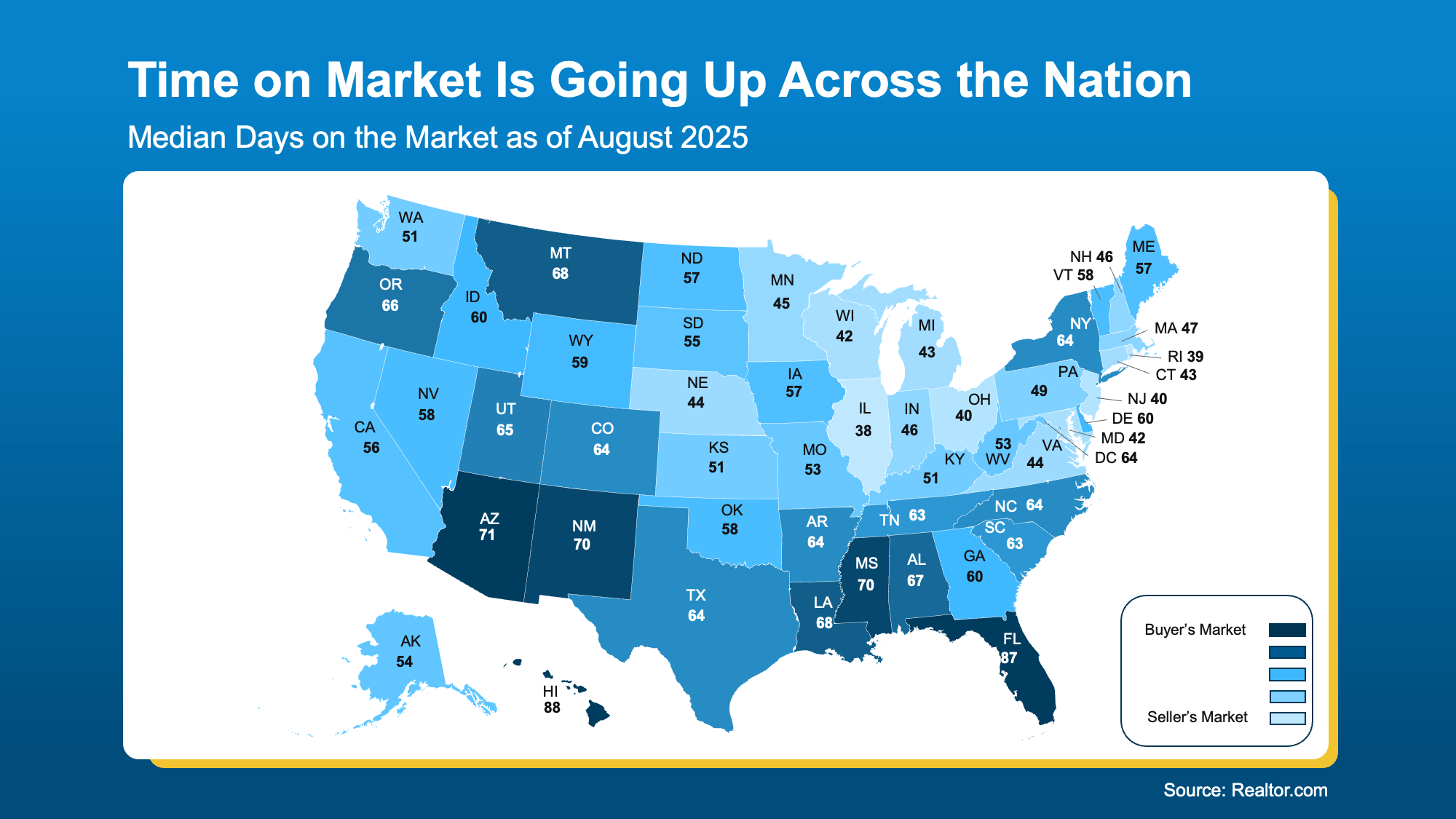

Time on Market Tells the Same Story

Time on Market Tells the Same Story

Finally, here’s how quickly homes are selling state by state. See the colors? For the most part, they follow the same general pattern with a lot of the darker blues being in the lower half of the country. And here’s why.

Generally speaking, as inventory grows, homes don’t sell as quickly. That’s why some of the same areas that have more inventory, see homes take more time to sell.

- The darker blues show where homes are staying on the market longer. That gives buyers more time and options, and signals sellers may need to adjust their expectations.

- The lighter blues are where homes are still moving quickly. Sellers there may feel more confident, and buyers may need to act fast.

This explains why some sellers in these darker blue states are feeling frustrated when their listings linger, while others in tighter markets (like the lighter blue states) are still seeing their homes sell quickly.

This explains why some sellers in these darker blue states are feeling frustrated when their listings linger, while others in tighter markets (like the lighter blue states) are still seeing their homes sell quickly.

Why an Agent’s Local Expertise Is the Key To Unlocking Today’s Market

Basically, the housing market is experiencing a divide. And conditions are going to vary a lot based on where you live, where you’re moving, and if you’re buying or selling. While the state-level information helps, what really matters is what’s happening in your town and your neighborhood. And only a local agent truly has the information you need.

Bottom Line

Want to know what conditions look like in your neighborhood?

If you want to understand which side of the market you’re on, connect with a local agent. They’ll walk you through the numbers and what they mean for your next move.