What To Look For From This Week’s Fed Meeting

You may be hearing a lot of talk about the Federal Reserve (the Fed) and how their actions will impact the housing market right now. Here’s why.

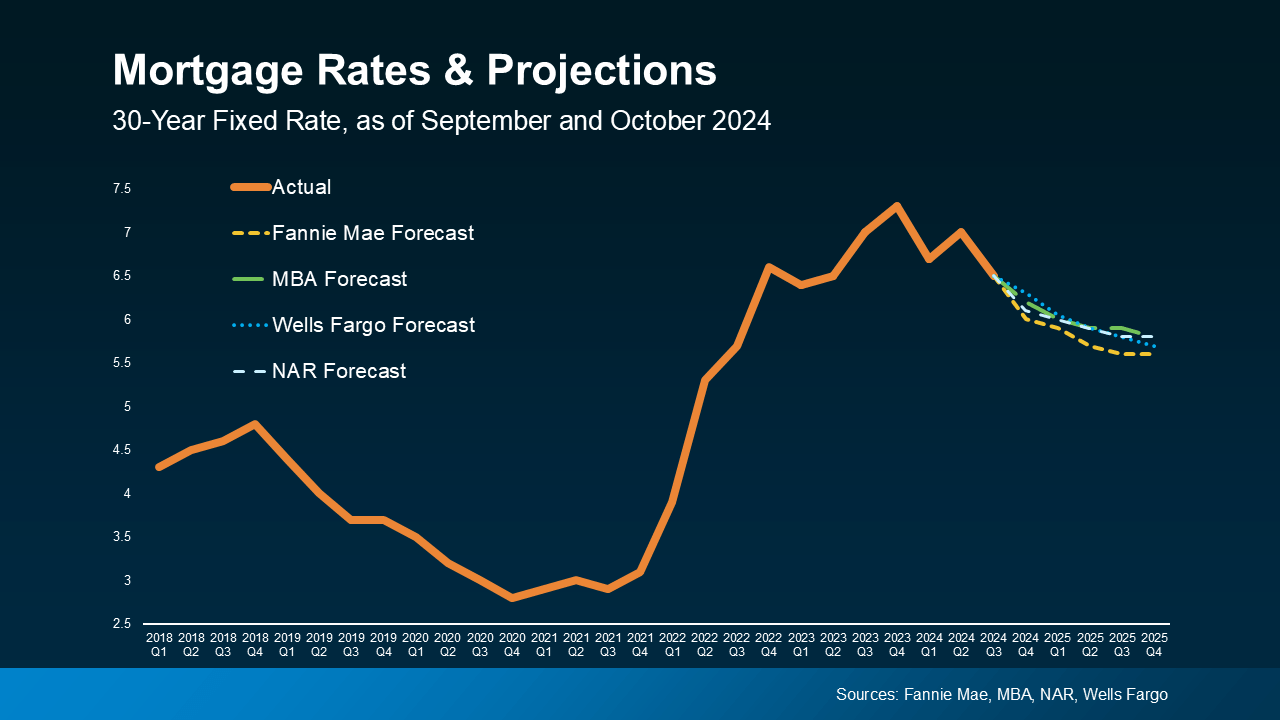

The Fed meets again this week to decide the next step with the Federal Funds Rate. That’s how much it costs banks to borrow from each other. Now, that’s not the same thing as setting mortgage rates, but mortgage rates can be influenced through this process. And if you’re thinking about buying or selling a home, you may be wondering about the downstream impact and when mortgage rates will come down.

Here’s a quick rundown of what you need to know to help you anticipate what’ll happen next. The Fed’s decisions are guided by these three key economic indicators:

- The Direction of Inflation

- How Many Jobs the Economy Is Adding

- The Unemployment Rate

Let’s take a look at each one.

1. The Direction of Inflation

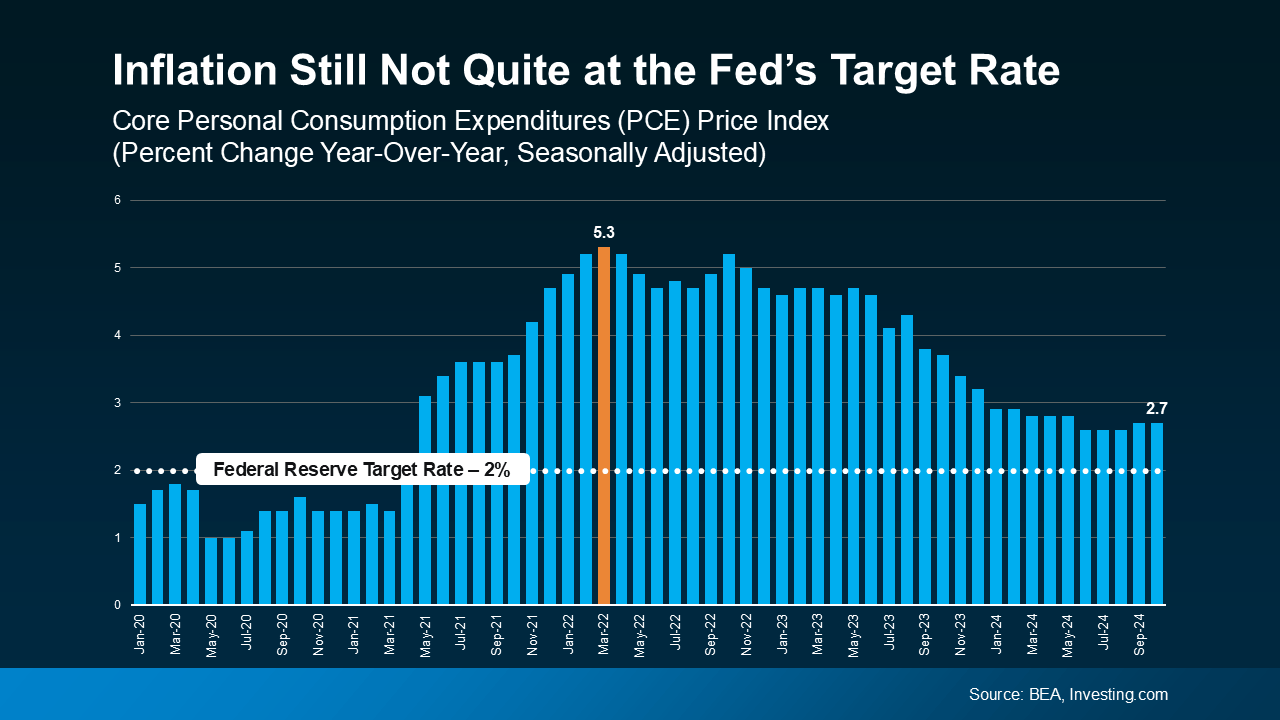

You’ve likely noticed prices for everyday goods and services seem to be higher each time you make a purchase at the store. That’s because of inflation – and the Fed wants to see that number come back down so it’s closer to their 2% target.

Right now, it’s still higher than that. But despite a little volatility, inflation has generally been moving in the right direction. It gradually came down over the past two years, and is holding fairly steady right now (see graph below):

The path of inflation – though still not at their target rate – is a big part of the reason why the Fed will likely lower the Fed Funds Rate again this week to make borrowing less expensive, while still ensuring the economy continues to grow.

The path of inflation – though still not at their target rate – is a big part of the reason why the Fed will likely lower the Fed Funds Rate again this week to make borrowing less expensive, while still ensuring the economy continues to grow.

2. How Many Jobs the Economy Is Adding

The Fed is also keeping an eye on how many new jobs are added to the economy each month. They want job growth to slow down a bit before they cut the Federal Funds Rate further. When fewer jobs are created, it shows the economy is still doing well, but gradually cooling off—exactly what they’re aiming for. And that’s what’s happening right now. Reuters says:

“Any doubts the Federal Reserve will go ahead with an interest-rate cut . . . fell away on Friday after a government report showed U.S. employers added fewer workers in October than in any month since December 2020.”

Employers are still hiring, but just not as many positions right now. This shows the job market is starting to slow down after running hot for a while, which is what the Fed wants to see.

3. The Unemployment Rate

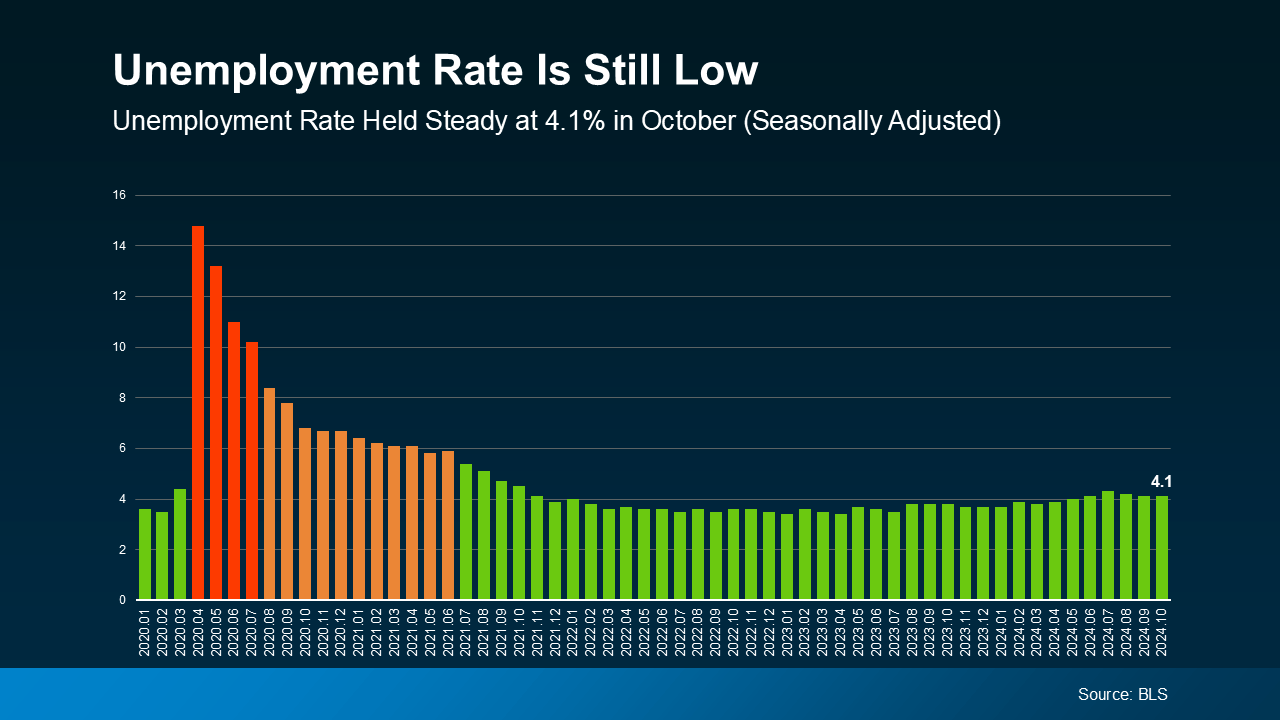

The unemployment rate shows the percentage of people who want jobs but can’t find them. A low unemployment rate means most people are working, which is great. However, it can push inflation higher because more people working means more spending—and that makes prices go up.

Many economists consider any unemployment rate below 5% to be as close to full employment as is realistically possible. In the most recent report, unemployment is sitting at 4.1% (see graph below):

Unemployment this low shows the labor market is still strong even as fewer jobs were added to the economy. That’s the balance the Fed is looking for.

Unemployment this low shows the labor market is still strong even as fewer jobs were added to the economy. That’s the balance the Fed is looking for.

What Does This Mean Going Forward?

Overall, the economy is headed in the direction the Fed wants to see – and that’s why experts say they will likely cut the Federal Funds Rate by a quarter of a percentage point this week, according to the CME FedWatch Tool.

If that expectation ends up being correct, that could pave the way for mortgage rates to come down too. But that doesn’t mean they’ll fall immediately. It will take some time. Remember, the Fed doesn’t determine mortgage rates. Forecasts show mortgage rates will ease more gradually over the course of the next year as long as these economic indicators continue to move in the right direction and the Fed can continue their Federal Funds rate cuts through 2025.

But a change in any one of the factors mentioned here could cause a shift in the market and in the Fed’s actions in the days and months ahead. So, brace for some volatility, and for mortgage rates to respond along the way. As Ralph McLaughlin, Senior Economist at Realtor.com, notes:

“The trajectory of rates over the coming months will be largely dependent on three key factors: (1) the performance of the labor market, (2) the outcome of the presidential election, and (3) any possible reemergence of inflationary pressure. While volatility has been the theme of mortgage rates over the past several months, we expect stability to reemerge towards the end of November and into early December.”

Bottom Line

While the Fed’s actions play a part, economic data and market conditions are what really drive mortgage rates. As we move through the rest of 2024 and 2025, expect rates to stabilize or decline gradually, offering more certainty in what has been a volatile market.