Why More Sellers Are Hiring Real Estate Agents

Putting your house for sale on your own – often called “For Sale by Owner” or FSBO – might be on your mind. But you should know that it gets complicated very quickly, especially in today’s complex market.

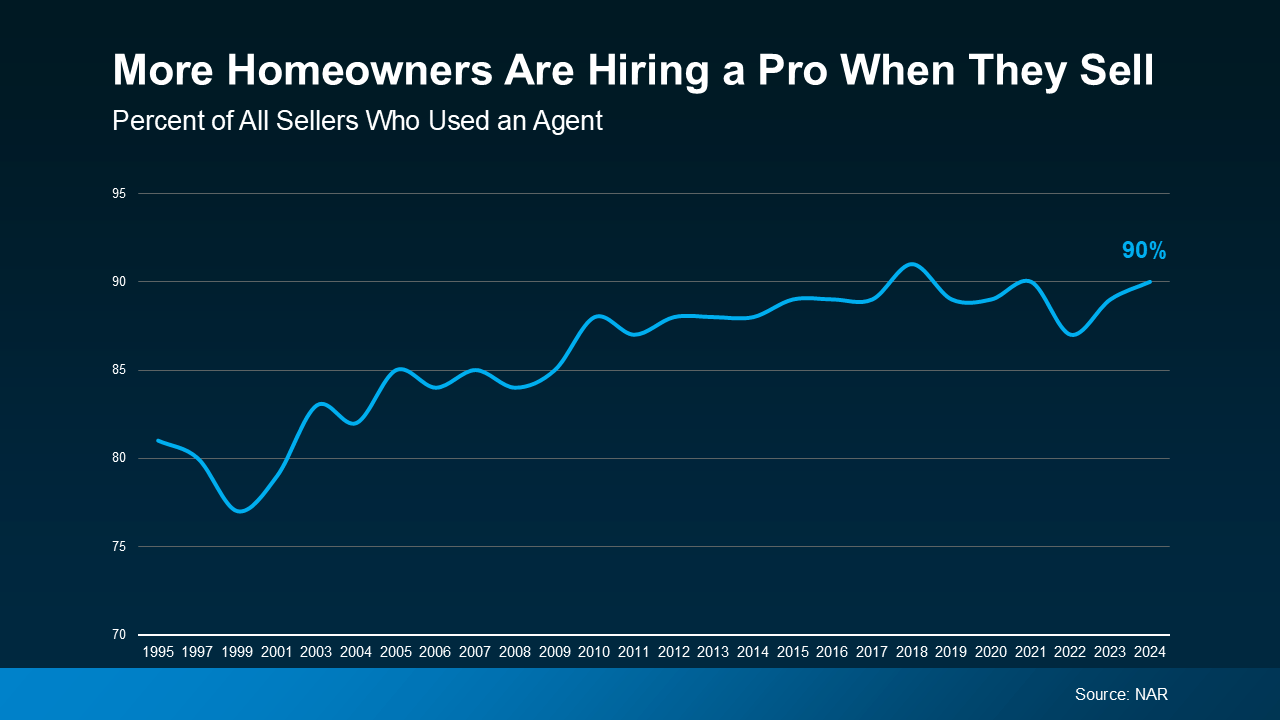

That’s why data from the National Association of Realtors (NAR) shows a record low number are going the route of selling on their own.

Instead, more and more homeowners are choosing to work with a real estate agent (see graph below):

And here’s why partnering with an expert is the go-to choice. Selling your home is a big deal, and while FSBO might seem like a way to save time or money, it comes with a lot of responsibilities.

And here’s why partnering with an expert is the go-to choice. Selling your home is a big deal, and while FSBO might seem like a way to save time or money, it comes with a lot of responsibilities.

The selling process requires setting the right price, navigating a growing amount of legal paperwork, and creating a solid strategy to attract buyers. And going it alone often means taking on more than you bargained for.

Let’s look at two big reasons why working with a pro can make all the difference.

1. Getting the Price Right

One of the biggest hurdles when selling a house on your own is figuring out the right price. It’s not as simple as picking a number that sounds good – you need to hit the bullseye. Price your home too high, and buyers may overlook your listing. Price it too low, and you could leave money on the table or even raise red flags about the condition of your home.

Real estate agents are experts in finding the right price for today’s market trends. As Zillow explains:

“Agents are pros when it comes to pricing properties and have their finger on the pulse of your local market. They understand current buying trends and can provide insight into how your home compares to others for sale nearby.”

With their knowledge of the local market, buyer behavior, and what homes like yours are selling for, an agent will help you make sure you set a price that’s competitive and that’ll draw in buyers. And it’s that perfectly strategic price that’ll set the stage for selling at top dollar.

2. Understanding and Managing the Paperwork

Another part of the process is dealing with a growing stack of paperwork, from disclosure forms to contracts. Each document needs to be completed accurately, and there are legal requirements to follow that can feel overwhelming if you’re not familiar with them.

This is another area where an agent’s expertise really shines. They’ve handled these documents countless times and know exactly what’s needed to keep everything on track. Your agent will guide you through the paperwork step by step, making sure it’s done right the first time and you understand what you’re signing. With their help, you can avoid unnecessary stress and mistakes that can lead to delays, legal complications, and more.

Bottom Line

Selling your house is a big decision, and having a trusted real estate agent on your side can make all the difference.

Connect with a local real estate agent so you have a pro to help with everything from pricing your home to managing the details. That way it takes the guesswork out of the process and helps you sell with confidence.