Should You Sell Now? The Lifestyle Factors That Could Tip the Scale

Are you on the fence about whether to sell your house now or hold off? It’s a common dilemma, but here’s a key point to consider: your lifestyle might be the biggest factor in your decision. While financial aspects are important, sometimes the personal motivations for moving are reason enough to make the leap sooner rather than later.

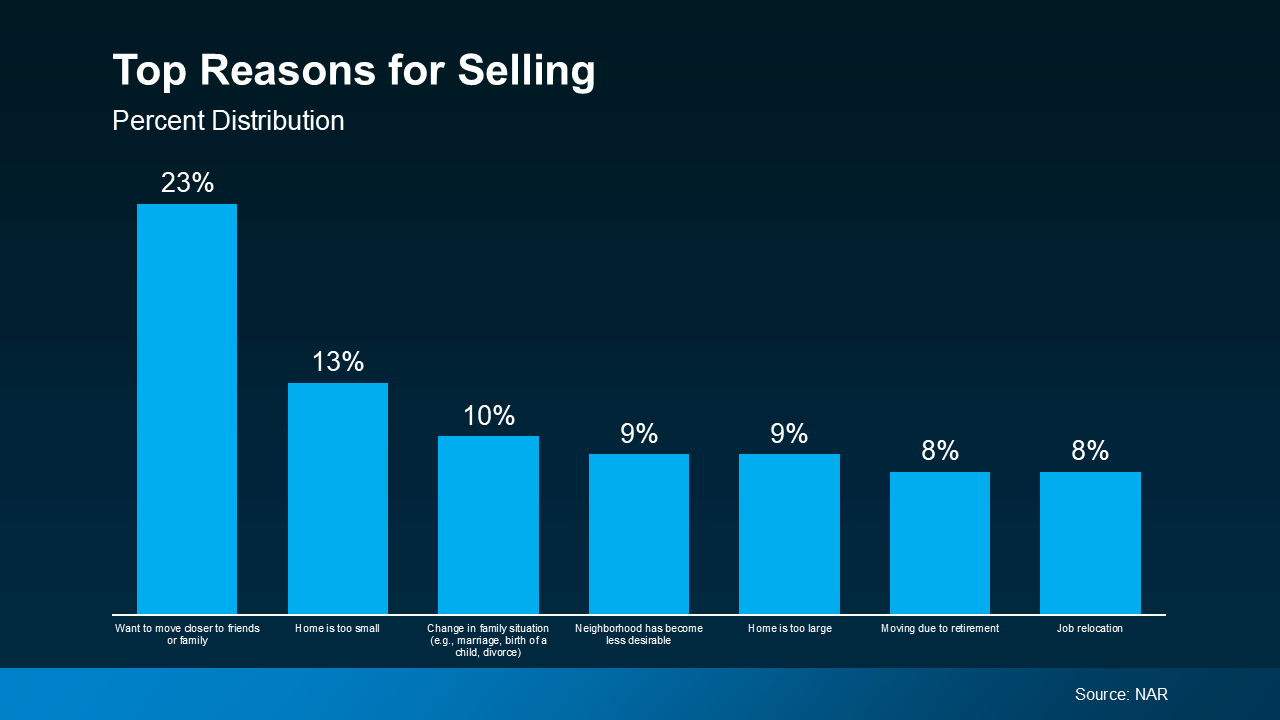

An annual report from the National Association of Realtors (NAR) offers insight into why homeowners like you chose to sell. All of the top reasons are related to life changes. As the graph below highlights:

As the visual shows, the biggest motivators were the desire to be closer to friends or family, outgrowing their current house, or experiencing a significant life change like getting married or having a baby. The need to downsize or relocate for work also made the list.

As the visual shows, the biggest motivators were the desire to be closer to friends or family, outgrowing their current house, or experiencing a significant life change like getting married or having a baby. The need to downsize or relocate for work also made the list.

If you, like the homeowners in this report, find yourself needing features, space, or amenities your current home just can’t provide, it may be time to consider talking to a real estate agent about selling your house. Your needs matter. That agent will walk you through your options and what you can expect from today’s market, so you can make a confident decision based on what matters most to you and your loved ones.

Your agent will also be able to help you understand how much equity you have and how it can make moving to meet your changing needs that much easier. As Danielle Hale, Chief Economist at Realtor.com, explains:

“A consideration today’s homeowners should review is what their home equity picture looks like. With the typical home listing price up 40% from just five years ago, many home sellers are sitting on a healthy equity cushion. This means they are likely to walk away from a home sale with proceeds that they can use to offset the amount of borrowing needed for their next home purchase.”

Bottom Line

Your lifestyle needs may be enough to motivate you to make a change. If you want help weighing the pros and cons of selling your house, connect with a local real estate professional today.