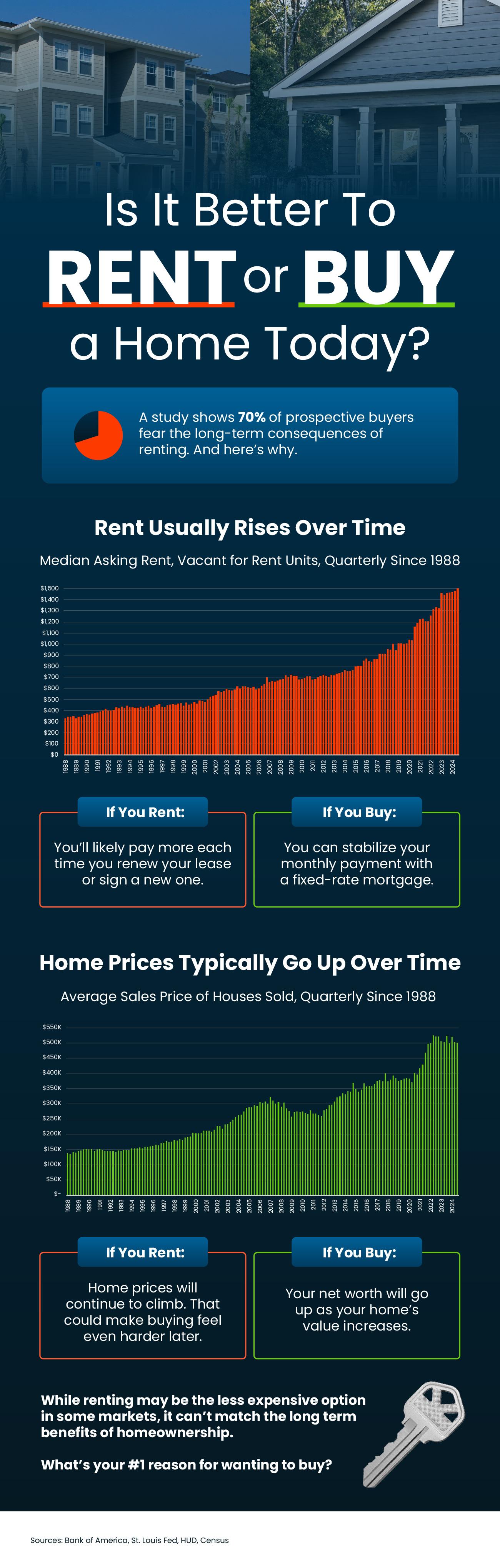

Is It Better To Rent or Buy a Home Today?

Some Highlights

- A study shows that 70% of prospective buyers fear the long-term consequences of renting. And here’s why.

- Rent usually rises over time and that can make it harder to save up to buy a home. But when you buy, you can stabilize your housing expenses and grow your net worth as home values rise.

- While renting may be the less expensive option in some markets, it can’t match the long-term benefits of homeownership. What’s your #1 reason for wanting to buy?

From the Archives

About Seth

Blog Categories

- Affordability (20)

- Agent Value (34)

- Baby Boomers (12)

- Buyer Successes (14)

- Buyers Incentive (1)

- Buying Myths (170)

- Buying Tips (77)

- Demographics (43)

- Distressed Properties (12)

- Down Payments (30)

- Downsize (2)

- drama (1)

- Economy (23)

- Equity (21)

- First Time Home Buyers (297)

- First-Time Buyers (28)

- For Buyers (657)

- For Sale by Owner (3)

- For Sellers (476)

- Forecasts (11)

- Foreclosures (38)

- FSBOs (17)

- Gen Z (9)

- Generation X (2)

- Holidays (7)

- Home Prices (57)

- Housing Market Updates (363)

- Infographics (195)

- Interest Rates (117)

- Inventory (40)

- Luxury / Vacation (2)

- Luxury Market (8)

- Market Updates (1)

- Millenials (2)

- Millennials (15)

- Mortgage Rates (53)

- Move-Up (2)

- Move-Up Buyers (284)

- Neighborhoods (2)

- New Construction (26)

- Pricing (184)

- Rent Vs Buy (62)

- Seller Successes (6)

- Selling Myths (123)

- Selling Tips (58)

- Senior Market (5)

- Short Sales (3)

- Time-sensitive (8)

- Uncategorized (20)